Did I say mandatory? I meant optional! You’re “free” to die in a cardboard box under a freeway as a market capitalist scarecrow warning to the other ants so they keep showing up to make us more!

I think a law stating you can’t borrow against unrealized gains would be sensible.

You can keep your unrealized gains forever, live of your dividends for all i care, and pay no tax. But realizing them, either through selling or borrowing against, triggers a taxation.

Are dividends taxed?

“Yes*”

*As with all rules, it can vary by country. As I understand it, the US tends to double tax dividends, which is a rabbit hole of why the US market chases valuation so hard

Dividends paid out to taxable accounts are taxed.

Dividends that pay into non-taxable accounts can accumulate until they are withdrawn.

So, for instance, if you own $100 of Exxon in a regular brokerage account and $100 in an IRA, the $5 dividend you get from the first account is taxable but the $5 from the second is not.

This gets us to the idea of Trusts, Hedge Funds, and other tax-deferred vehicles. If you give $100 to a Hedge fund and it buys a stock in the fund that pays dividends, it never pays you the dividend on the stock so you never have to realize the dividend gain. You simply own “$100 worth of Citadel Investments” which becomes “$105 worth of Citadel Investments” when the dividend arrives.

I think dividends in a tax-exempt accounts, like a traditional IRA, are only not taxed if you reinvest the dividend or just leave it in your brokerage account. If you move money from your IRA account to, say, your checking account, that’s when you pay taxes (and there are generally fees for moving money out of tax exempt accounts without meeting certain conditions, like being of retirement age).

I think dividends in a tax-exempt accounts, like a traditional IRA, are only not taxed if you reinvest the dividend or just leave it in your brokerage account.

Right. Although, with a ROTH IRA, you pay taxes before you put the money in. Then you earn tax free even after you take it out. That makes it the preferable vehicle for long-term savings (you should expect your initial investment to double every 10 years, assuming a 7% ROI which is fairly modest - so over 30-40 years you’re saving 8x on the eventual withdrawal).

But this isn’t just limited to IRAs. Using investment funds, you can pull the same trick. Buy the fund, then allow the broker to shuffle the investments within the fund as they please. You only “earn” the money when you exit the fund, in the same way you only “earn” your retirement when you withdraw from your IRA.

Savings accounts and trusts can then be structured to be inheritable tax-free, with your heirs having access to withdraw from the fund without ever actually owning the money (and thus needing to pay taxes on the inheritance). And to make it even more squirrelly, you can borrow against these funds, which allows you to make large purchases without ever actually spending any money. This maneuver, plus a cagey use of declared loses, means you can avoid paying any tax on any investment income virtually indefinitely.

There is a big maybe on whether Roth is better than traditional IRA/401k.

My kids are at the age where they are making those bets now. So I made a hugely complicated forecasting tool to forecast which would be better.

I think it really comes down to your view on future tax rates.

Your mileage may vary.

I think it really comes down to your view on future tax rates.

Unless you’re banking on a 0% tax, the ROTH is hard to beat. Compound that by the Traditional IRA being taxed at the normal rate rather than the capital gains rate, and there’s very little reason to use it unless you’re really bullish on tax cuts in the long term.

I largely agree with all the points made here however I think the overall message is a bit misleading. I would disagree that Roth investments are the preferred for long term investments. You aren’t accounting for the opportunity cost of the taxes paid in the initial investment year. Those taxes, while small compared to what you will withdraw tax free are also losing out on 8x-ing themselves (as you would have invested that amount in a traditional tax advantaged account).

What this means is Roth is the preferable savings method if you are in a lower marginal tax rate than you expect to be in retirement. However traditional is better if you are in a higher marginal rate than you expect to be in retirement. If the marginal tax rate was the same when you invest and retire then the difference between Roth and traditional would be nil.

You aren’t accounting for the opportunity cost of the taxes paid in the initial investment year.

If you’re maxing out your contributions, it won’t matter, except in so far as what you can earn on taxed income outside of the IRA account. That’s going to be marginal relative to the contribution. And the compound returns inside the IRA make it meaningless.

What this means is Roth is the preferable savings method if you are in a lower marginal tax rate than you expect to be in retirement.

Unless you’re going straight into a white shoe law firm or extraordinary paying tech job after you graduate, that’s pretty much everyone. But even folks going into Fortune 500 companies typically start in the $60-80k/year range and climb up from there.

If the marginal tax rate was the same when you invest and retire then the difference between Roth and traditional would be nil.

The amount of money you have in the fund is going to be much larger.

Say I invest $5000/year up front and get a 10% return for 40 years. I’m looking at putting in $200,000 over that time and taking out $2.2M.

Assuming the tax rate is 25% for each of those years, I paid $50k in taxes to invest that initial $200k. But I get the $2.2M back tax-free.

If I put the $200k in tax-deferred, I have to pay $550k to get my balance out again.

Now, we can argue that I could put the $400/year in deferred taxes into a taxable savings account. And maybe we get clever by shielding that investment from taxation annually because we just shove it all in Microsoft or Berkshire B and let it ride. That nets me another $177k over 40 years, assuming the same rate of return (for which I’m still on the hook at 15% long term gains rate - so really only $150k).

The ROTH is $350k better. That’s the whole reason the fund exists. It’s another accounting gimmick to give wealthy people a stealth tax cut. Only suckers put their money in Trad IRAs.

You seem to be using many different assumptions separately. In the first you assume you are maxing a Roth IRA (in my initial response I was also considering 401ks as many of them have Roth options nowadays). If you are maxing your Roth 401k and Roth IRA you are likely a high earner and therefore likely in a higher tax bracket than you will be in retirement. This means that kind of person will likely prefer traditional investments.

Your assumption there is someone maxing out their retirement options and in a relatively low tax bracket doesn’t seem like reality. So in your math example they wouldn’t be putting the extra in a taxable brokerage account but in the same tax advantaged account.

Quick edit: also I’m confused on the extra $400/year into taxable account. It should be $1,250 per year (25% of the 5,000) which would be closer to $600,000 before the capital gains tax.

Thanks for expanding on the finer points! With inheritance, they also reset the cost-basis when the owner dies, which means that all the capital gains accumulated over the time that the deceased had ownership is never taxed. Like, if I bought stock for $10, die when it’s worth $100, my sister inherits it, and then sells it for $110 a while later, she only pays capital gains on $10 – not $100.

I don’t think people fully realize how dramatically our tax code rewards capital, at the expense of labor, not just in the broad-strokes (like the tax rate for capital gains vs the rates for income tax brakets) but also in these little details that are easy to overlook. So thanks for the discussion!

Yes

Not sure if it’s the same everywhere, but if I pull a dividend I don’t pay tax initially, but when I do my income taxes it’s part of my income and I’d have to pay tax on it then

Careful with that. If you’re not making estimated tax payments on your dividends (or other capital gains) every quarter or increasing your withholdings from wages to compensate, and you owe too much at the end of the year, you can get hit with penalties and interest.

For most people the quarterly dividends in their brokerage aren’t enough to trigger that, but as your savings grows and quarterly dividends become significant they might.

Where I’m from, we don’t do that. All dividends come with an “imputation credit,” which basically says “this money’s already been taxed.”

Mhm. There’s two very good reason unrealized gains aren’t taxed: volatility and cash flow. Are you and the government expected to swap cash back and forth everyday to correct for changes in the market? No that’s silly. Should people go into debt because they don’t have the cash to pay the taxes of a baseball card they happen to own that is suddenly worth millions? Also silly.

For that same reason, using unrealized gains as security is dangerous, just like the subprime loans market was!

if you secure debt against them, they should be taxed?

Yeah owning a baseball card worth money sure whatever, if you pawn that card sorry, pay taxes. You use that card a to secure a loan with lower interest rates than you’d get without then sorry, you are realizing gains whether or not you want to admit it. This goes along one of the lawsuits against Trump. He lied to get favorable interest rates by overvaluing his assets to get better interest rates. If that’s against the law why the fuck is that not counted as a “gain” to use assets to secure favorable interest rates?

There’s a very good reason they should be taxed; half a dozen people are richer than god, and basically never pay any real amount of tax.

This would effectively lock out every small investor from the stock market due to the liability of both success and failure.

How so?

“Oh no, I made money, better put a small percentage of my gains away for tax season, just like I do with all of my income, because I’m American and lack a good PAYE system”.

deleted by creator

Someone here has made a false assumption. In fact, I’m pretty sure we both have made several. The question is who has made a fatal false assumption? Let’s go.

My root comment, at the top of all of this, was my idea that perhaps we should consider gains “realized” when they are sold OR used as a collateral in a loan.

Your assertion is that it would wipe out small investors.

I would question how many small investors are using their small investments as collateral in a loan?

deleted by creator

No it wouldn’t. The proposal out there right now has a floor of something like a million dollars. Most of us will never need to worry about that.

I mean the stock market is literally gambling, so the risk of success and failure is already there. The proposal is whether or not we should allow people to use unrealized gains to secure loans without having to pay taxes on said gains at the point of taking the loan. This would only occur if you’re worth more than 100 million. You can afford to pay that tax.

I mean the stock market is literally gambling

I’ve a better record of success than the most successful poker players. Is it ten years of good luck or the consequences of effort and skill?

The proposal is whether or not we should allow people to use unrealized gains to secure loans without having to pay taxes on said gains at the point of taking the loan.

Thus locking out all non-corporate investors from margin, prerequisite to options, prerequisite to risk mitigation and gains enhancement. The average investor looses the freedom to do much more than DCA a fund.

This would only occur if you’re worth more than 100 million.

-

It’ll never be passed in such a way. Legislation always favors the corporate and wealthy as they’re the ones that write it. It’s most perverse in finance and investment. There’s been nothing favoring human investors since the breakup of Ma Bell.

-

It’s totally inadequate to save the republic from the nearly-unmitigated, algorithmically-optimized capitalism that exists today. The biggest fish, corporations, would simply get bigger by eating their biggest threat: humans with a lot of resources, but not the most affluent.

The stock market is a tool. It’s not the cause.

TL;DR:

The neolib’s proposal is crap.

This isn’t:

-

legislate away most of corporate personhood

-

restore the Glass-Steagall Act

-

repeal the Interstate Banking and Branching Efficiency Act

In no part of your response did you make any sense or a rational point, demonstrating a clear lack of understanding and a wanton disregard for good-faith arguing. Troll gonna troll I guess.

I can’t dumb it down any more. Perhaps another can do so.

-

Good

We’re talking about the stock market. And it would be quarterly or annual. Please stop exaggerating.

There’s a precise moment in time you take a loan. Use that moment in time to calculate worth; tax.

Sure, but this shouldn’t apply to everybody. Unrealized gains up to $10 million don’t get taxed. Unrealized gains over that amount get taxed.

If you pay it yearly you’re not paying this every day. People with this much money almost always go up in unrealized gains every year, so it’s not going to be a back and forth. It’ll be a yearly adjustment. No different than literally everybody else that pays taxes on their new wealth every year.

Edit: as for the baseball card example, if you’ve got over $10 million in unrealized gains on baseball cards, yeah, maybe you pay taxes on that.

Or doing so, it counts the loan as income and is taxed accordingly. But seriously, the main aim itself can also be taxed. A house is…

You’d have to put some controls in there for that solution to work. Hitting new homeowners with an immediate tax on “earning” $1,000,000 to pay for their house seems a bit cruel.

The unrealized gains is for 100 millionaires or more. I don’t think there is anyone with 100million in unrealized home value.

I was talking for a hypothetical world where that law isn’t a thing and simply paying capital gains in “realized” gains is.

Nut hey, yeah, sure, 100mil works too.

Capital gains are applied against a cost basis, in the case of your homeowner, their purchase price. Unless the house appreciates in value there is 0 capital gain, even if you made the mortgage a realization event and for some reason implemented this with no residence exemption or tax brackets. It’s mad how this point has to be repeatedly explained through this thread.

That was my thoughts as well.

Wouldn’t that affect things like Home Equity loans?

Homes are taxed based on assessed value. They are already a form of taxing unrealized gains.

Most of the population either has:

- no unrealized gains

- gains in a retirement account that we can’t borrow against

- gains in real estate that are taxed, but can be borrowed against

- a combo of 2 and 3

I think it’s fair to ask that the rich play by the same rules. You can either borrow against your gains and pay taxes on them, or not pay taxes and not be able to borrow against them.

No because the mínimum for this to apply is 100 million.

The government also told the public that the income tax was going to apply only to rich people, how’d that turn out?

Depends on the exact implementation, but sure, you could happily write a version where an initial home loan isn’t hit, and only “top up” loans against the INCREASED value of your home is targeted.

How are you going to enforce that? The Bank can cite whatever they want for giving the loan.

If we just tax them then it’s easily enforceable and it’s done.

It can just be flipped on it’s head;

How are you going to enforce taxing on value, the person can just cite whatever value they want for the asset.

No they actually can’t. In stocks the price is publicly listed by a third party. In real estate an assessor gets involved. For commodities like cars they have to be unique or nearly so before there isn’t a third party listing it’s value.

For edge cases, especially large real estate, we could always make a second law, one that says the government can buy your building at the value you gave the IRS if it’s significantly below market rate on dollars per square foot for it’s type (office, industrial, residential, etc), or that it’s represented as a higher value in investment reports or bank loans. We’ll frame it as a bail out, helping them offload toxic assets. Then the government sells the building on the open market. That way when someone like Trump decides his buildings are suddenly worth less than all of the surrounding buildings we can keep him from going bankrupt again.

https://www.propublica.org/article/trump-fraud-ruling-property-valuation-michael-cohen

A former sitting president has been indicted, if not convicted of this very crime. You’ll have to excuse me if I don’t believe it’s that uncommon.

It took literal decades and the magnifying glass of running for public office. I’m not comfortable with that being the standard.

It is the standard. Now. Currently.

If you don’t like it, might I suggest a guillotine or several. Worked for the French.

Or, we could pass a law changing that standard.

deleted by creator

This.

Seems more reasonable than taxing unrealized gains, although I’d prefer if the debate was on how to cut absurd amount of spending rather than trying to find new tax streams.

I’d rather we went back to taxing the rich properly and stopped having crumbling infrastructure.

I think the real solution is not to lend on fake money. Tax or no tax, it wasn’t taxes that caused the market crash in 2008.

Thank you. Even if they pass something it will be written by a bureaucratic bean counter and will be riddled with loopholes.

Simply don’t allow loans on stocks. Keep it simple.

deleted by creator

Ok but then you’ll pay taxes on that sale so there’s no problem.

That’s only for you humans. We corporations only pay if we net a profit. Also, if we loose money, we can carry it over to next year as a tax exemption. Good luck, ugly bags of mostly water.

Eh so… If you lose money you also can carry the tax rebate over to the next year in the US…

deleted by creator

Yes, humans as well.

Same as companies, just a different maximum amount per year and what’s left can be applied to the next year and the next and the next…

All money is fake money, though.

The real money is the friends we made along the way who owe us favors.

That doesn’t work. It’s not enforceable.

Not enforceable as a law, but not bailing out those who do it is a great way to put an end to it.

I’d rather just have it done than give them another thing they can pressure politicians to bail them out of later.

Then good luck getting a house mortgage because you can’t lend based on future income because it’s not guaranteed. When I bought my house they incorporated the value of my brokerage account. I wouldn’t be able to own a place if they didn’t.

With house mortgages it’s collateralized against the house, a physical object, but it has only a fake value until it’s actually sold because house prices can go up or down.

I don’t agree with unrealized gains taxes in general, but the instant they are used as collateral, or if value in any way is extracted from them (even loan value), they become realized gains, and should be taxed.

deleted by creator

deleted by creator

Yeah, a bank isn’t going to give your a $500k mortgage on a $200k property, so if they give you a $500k loan on stock then that’s the value given to the stock at that point.

I don’t agree with unrealized gains taxes in general, but the instant they are used as collateral, or if value in any way is extracted from them (even loan value), they become realized gains, and should be taxed.

What you’re suggesting would also mean you’re advocating for middle class homeowners to be taxed on a full value of a Home Equity Line of Credit (HELOC) even if they haven’t spent a dime of it yet. Was that your intention?

Homeowners are excluded from capital gains tax for the first 250k for individual filers.

I believe you’re referring to rules on sale of a home where there is a capital gain, meaning you bought the house for $100k and sell it for $350k, no cap gains taxes. We’re in uncharted waters with what @[email protected] is proposing. That user (possibly) suggesting it for HELOCs too.

Okay but you can just apply the same logic to a HELOC. If you get a 30k HELOC for a bedroom renovation then it does not count towards capital gains tax.

Even normal capital gains taxes have brackets.

Okay but you can just apply the same logic to a HELOC. If you get a 30k HELOC for a bedroom renovation then it does not count towards capital gains tax.

Wouldn’t this be a double standard if we’re applying @[email protected] 's logic? The rich would get taxed on loaned money but the middle class wouldn’t?

That’s generally how progressive tax brackets work, yes. Technically speaking if I rich person wants to take out a 30k HELOC they’d also not get taxed on it.

that’s like the point of the entire system? I mean, I don’t want to go back to the 1800s corporate baronies that defined most industry at that point in time

This is how… EVERYTHING works… Income tax brackets, 401k limits. I thought this was pretty obvious, from each according their ability and all.

The rich would get taxed on loaned money but the middle class wouldn’t?

Oh no… Anyway.

Oh no, I guess our legislators’ hands are tied. It’s not like they could just put an exemption for a person’s first home into the law or anything.

Oh well.

deleted by creator

They didn’t set out their whole tax platform for their presidential bid friend. We can trivially blow down your straw man with a primary residence exemption or, you know, tax brackets.

Simply tax it as if it underwent a buy/sell/trade. Capital gains and losses are accounted for in that at the time the value is utilized. They are tracked, and you don’t pay them later.

Reasonable home ownership (only home) could be exempted.

How does this actually make any sense though? All collateral is, is a safety net to mitigate loss for a lender who lends to someone who then defaults on the loan. If the loan is not defaulted on, literally nothing happens to the collateral.

How then does it make any sense to consider the mere act of the loan being given as a realization of the collateral, in other words, equivalent to having sold the collateral, when literally nothing has happened to it?

This feels completely arbitrary. Using an asset as collateral is nothing like realizing it.

Realization is the establishment of value not sale for cash (it just happens that the most convenient establishment of value for any non-fungible asset is sale). There are already some realization events that don’t have associated cash flows, to do with overseas assets or certain financial instruments. Ordinary people don’t need to worry about this stuff, it’s not for them, and if you’re rich you can trivially figure out the cash flow issue.

But capital gains avoiding tax for the life of a wealthy person who lives off collateral zed borrowing, then being stepped up in basis for their heirs is just embarrassing for the US.

Realization is the establishment of value not sale for cash

Absolutely nonsensical massive straw-grasp. If that was true, that would mean that everything that HAS a widely-established market price is instantly and permanently to be considered realized by everyone who owns it.

Relevant case law: “While it is true that economic gain is not always taxable as income, it is settled that the realization of gain need not be in cash derived from the sale of an asset” https://supreme.justia.com/cases/federal/us/309/461/

It is in fact true, and clearly then doesn’t mean that at all. We can and do control what constitutes a realization event, and borrowing is a pretty sensible candidate. I don’t know why you’re losing you mind over this fairly prosaic idea.

You left out some pretty important context in that quote to make it seem like it’s saying that realization is arbitrarily decided. In truth, all this is saying is that realization is not confined to reception of cash itself:

While it is true that economic gain is not always taxable as income, it is settled that the realization of gain need not be in cash derived from the sale of an asset. Gain may occur as a result of exchange of property, payment of the taxpayer’s indebtedness, relief from a liability, or other profit realized from the completion of a transaction.

As it says at the end there, the ways to realize gain all necessarily entail “profit”. A loan is not profit, nor is an already-owned asset transform into profit when used as collateral.

The above could absolutely not be used to support your argument, nor refute mine–not when you read it honestly and in context.

The capital gain is the profit, the collateralized lending is the transaction completed to realize that profit. It’s a logical extension of accepted understandings of those terms and easy to imagine coherent legislation to implement.

You don’t like the idea, that’s fine. But it’s simply not true to claim that it doesn’t make sense and you haven’t been able to articulate any inconsistency. Just saying “nuh uh that’s not profit” is pointless. We all know it doesn’t constitute realized gain in the existing system of laws, but OP and others are suggesting it would a be a sensible way to tax the extraordinary benefits that the ultra-wealthy take from their appreciated assets. It’s been explained to you politely and with sources, if you have nothing more serious to add to the conversation I’m done giving you the benefit of the doubt.

And WHAT gain exactly is being taxed? So you have a $1000 investment. The government decides, what, that you are a good investor and can make 20% so they’ll tax you on $200? So if you sell it at a loss, you get screwed. If you sell it for a 50% gain the government loses tax revenue? You know what, I’ll take that deal. I’ll invest money, pay the taxes on my unknown gain immediately, keep it for 20 years and boom, tax free, because I’ve already paid the taxes on the gain. You know I’m totally on board with this whole rich people suck idea, but this is just stupid.

ok, so I understand that you don’t quite get the issue, also your bad at taxes.

if I invest $50000 and make $100000 I don’t want to pay taxes on the $50000 I “made” (this normally would lead to the crime of not paying taxes) but if I use those $50000 as leverage on an extremely low interest loan for $50000 then I dodge having to pay anything in taxes while also, defacto, realizing my gains.

what OP is advocating for is taxing those $50000 you put up as collateral, making these $50000 similar to the original $50000 you invested, now should you again make another $20000 from said capital, and pull out, you would still have to pay capital gains on those $20000, or do you think you have to pay capital gains on money you put in? (hence why you’re bad at taxes) because tax is only levied on the positive difference

I love the way people on the internet have to insult to make a point.

I’m just glad you’re not the one making the tax laws.

I’m not insulting anyone, if you feel slighted about the fact that you didn’t understand OP, nor do you understand how taxes work, then I invite you to do some basic research about tax law in the US, because you don’t seem to know how taxes work

You know, I heard that rich people need air to live, we should totally tax the crap out of that. That would show them.

you’re lacking English or economic comprehension skills are no reason to start creating straw men, you’re wasting all that bedding for the rest of your fellow sheep

Wait…I pay taxes on my HELOC…

You’re “free” to die in a cardboard box under a freeway

Actually… They made that illegal. You’re free to rot in prison for being homeless, though!

If it’s one homeless guy dieing under the bridge it’s a capitalist scarecrow sothat other people work harder.

If it’s a hundred homeless guys dieing under bridges the people understand that the problem is not them, but capitalism. That’s illegal.

Capitalist Scarecrow is such an effective term. It feels like enshittification in the way that I see it everywhere, and now I finally have a word for it.

edit: wording

Sitting here, watching every town council around my area pass a homeless ban after that SCOTUS ruling. Even the newspaper suddenly switched and said popular opinion swung 180 degrees in the last six months.

What the fuck does one do at that point? It’s obviously manufactured consent. It’s blatantly unconstitutional to tell people they can’t exist on public land. It’s a human rights violation to be stuffed into a shelter that demands you be a better human than people who already have housing in order to get house money. At this point we’re just turning the homeless into the new scary minority.

The goal is extermination and genocide. There is nowhere for the homeless to go except into the ground as dead bones, where they won’t bother the privileged and rich anymore.

I don’t know if we’re there, but that’s definitely one way Automation has been theorized to go.

Three hots and a cot is better than nothing…

Well then there’s the forced labor.

Yeah, unfortunately.

That’s how the rich get richer. They never gamble with their own money. They gamble with other people’s money, secured (hah) by their assets.

Yes a minority of us peons who are privileged enough to own property or lots of stocks can play-act like they’re rich by taking out reverse mortgages or doing options trading, but it’s nothing like what the actual rich can get away with.

The top 10% own 67% of the wealth in the U.S.

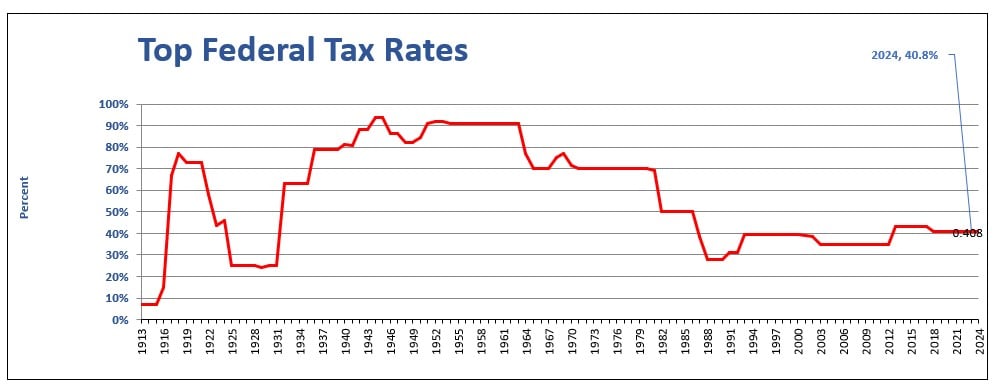

The tax rate during the New Deal (which corresponded with the largest jump in GDP and middle class growth) on people earning $200k and over (now would be like earning $2.5 million/year) was 95%.

During the 50’s through the early 80’s, that tax on the wealthiest was at 70%.

Now it’s at 37%, less than half of what it was during the best years of growth our country ever experienced.

This Unrealized gains tax would only impact people worth more than $100 million who do not pay at least a 25% tax rate on their income.

Additionally, you’d only pay taxes on unrealized capital gains if at least 80% of your wealth is in tradeable assets (i.e., not shares of private startups or real estate). One caveat is that there would be a deferred tax of up to 10% on unrealized capital gains upon exit.

In short, it would not apply to most startup founders or investors, but would impact top hedge fund managers.

They can afford it. TAX THEM.

Anyone seriously talking about the 95% rate can be safely ignored as a liar by omission.

The amount of stuff you could deduct was very different back then. Nobody actually paid 95%, regardless of what the law literally said.

There is a reason this person is not showing you per capita tax revenue over the same time period.

I’m curious, could you provided these numbers?

So how does taxing unrealized gains work. If I purchase stock X at a specific price. If the stock goes up and I now am holding 150% of my original value. Let’s say it hovers there for 3 more years. After 3 years it tanks and is now worth only 50% of my original purchases. Are people suggesting that I pay taxes on the unrealized gain of 50%, even though I end up selling at loss and have realized negative value. Doesn’t that mean I am being taxed on losing money? How does that make sense?

The moment you use them as a collateral, they should be taxed as money.

You took a 10 billions loan with the actions you have as collateral? You pay taxes on these 10 billions.

Right now, the system is rigged because the richs get to transform their collateral into liquidity while paying 0 taxes on that, and they can even write off the interest on the interest incurred.

I guess that’s whats lost in the meme. Just because you “can” use something as collateral doesn’t mean you “are” using something as collateral. The language should be more accurate to describe actual use vs hypothetical.

Frankly I feel like the better option is to just not let people borrow based on stocks at all. Even if you paid in at X price, there’s no guarantee it’ll still be at X price or greater when the loan comes due, so to speak.

I mean, in the UK, we see the “loan against unrealised, paid off to a zero tax position” trick as the disguised remuneration package that it is.

In fact, it only America, out of the western nations, that allows that.

You took payment of a sum of money, specifically related to unrealised gain. Therefore, the gains are realised.

Thank you. This is the correct solution.

You took payment of a sum of money, specifically related to unrealised gain. Therefore, the gains are realised.

I don’t think this is accurate. I’ll break down what I mean.

You took payment of a sum of money

Yes.

specifically related to unrealised gain

Yes.

Therefore, the gains are realised.

No. Gains realized would be an unambiguous outcome with zero question to the providence or final outcome. That isn’t what a loan against assets are. There is a third step you’re skipping.

A lender is making a business decision to absorb the risk of giving you money where they may not get their money back even with the asset you gave them. The value of the assets can change both positively (which would be immaterial to the lender) or negatively (which would absolutely be material to the lender).

In today’s rules it means that the lender would lose out if the borrower defaults, and the collateral asset sells for less than the loan amount. The only loser is the lender, and they are choosing to take that risk. The worst case scenario to the lender is losing 100% of the loaned amount (plus whatever trivial costs of administrative overhead for servicing the loan) because the asset is worthless.

In the rules you’re proposing (the worst case scenario) if the borrower defaults, the lender loses 100% of the loaned amount, the borrower loses 25%-33% of the value of the loan, and the government would gain 25%-33% of taxes on money that never existed because the asset is worthless.

Don’t you worry. I know very familiar with what you mean.

I’m not suggesting that Americas tax rules haven’t been utterly compromised by billionaires. I’m saying that, in other countries, that’s tax evasion.

They would have to sell to realise the loss and declare it to claim the tax relief. The other alternative is that billionaires never pay tax on their capital gains and that would be a bat shit crazy way to run an economy.

Realization isn’t restricted to “unambiguous outcome with zero question to the providence or final outcome” even in the existing tax code, and what does “final” even mean.

It’s mostly an administrative convenience that we work with sale as the archetypal realization event. And collateralized borrowing is a very good candidate for realization as it inherently involves valuation.

Regarding losses, yeah you could then realized losses which could be used to offset gains from other sources, rolled forward into future tax years and so forth. That’s all a pretty normal part of wealth and tax planning for people with ample and complicated finances. They hire people to handle this, don’t worry about them.

No…see you bought the stock. You don’t have enough of a hoard for us to worry about not to mention the value of that stock will be used in the economy more than likely when You retire or need it.

How it will work is you are an early owner or investor and your hoard pile is over $100 million. Now when your hoard pile goes up 7% you have $107 million. We tax you on your wealth over $ 100 million. Let’s say 25% tax on that $7 million if you choose to hold onto it. Your wealth tax bill will be $1,750,000 that year (plus minus other factors). You can choose to sell your $7 million and it is currently taxed at 18% for realized tax gains if you held onto the stock for over a year or income % tax rate if short term trade.

What this does is increase the public ownership in companies as there is more stock for everyone and decreases the hoarding of companies by the wealthy. It also makes stock prices more honest so people don’t hoard the stock count to inflate prices.

Let’s say you own other assets. A house. It is just like property tax if you can’t afford the tax bill you don’t own the house or…your house isn’t worth that much. If you have tons of homes you may have to sell it to the people rather than rent. And if your hoard of assets is in other random collectibles you pay the tax bill to maintain your collection or share the ownership with others.

As for private companies that will be an interesting thing. I would say when your company is worth $100 million you have to divest the ownership to others. But idk. Legalize will figure it out we can also have exceptions for things like house value or other random things

Unironically, isn’t that exactly how property taxes work on land and housing?

Housing is taxed at the value of the property, not the difference between the value of the property and the purchase price.

housing exists

Why not tax on a regular basis based on the current value, just like we do with houses?

deleted by creator

It’s not. Unrealised gains is basically an item in your shelf that hasn’t been sold, you can tell other people this item worth X now and you can get a loan with that item as a guarantee, but since you haven’t sell it and turn it into money, you still have $0 and an item that worth X. These people failed basic economic.

“can” vs “do” are different things. The meme quote describes hypothetical use, not actual use, as being something that should be taxable.

What you mean by “hypothetical use” vs “actual use”? In your own comment you mention nothing about “hypothetical use” yet here you talk about one, OOP also failed to mention anything about hypothetical use and only talk exclusively about unrealised gain. If unrealised gain(stock, asset, etc) is used to trade for another item, then yes, it’s already a realised gain, the tax should be levied on the item purchased or the asset sold, whichever makes sense. If the unrealised gain is used to secure a loan, then no, it shouldn’t be taxed because it’s only change hand on paper, and the loan came with interest, and you have to pay back that loan. Net worth is nothing but a dick measuring contest, taxing it makes no sense.

So no, unrealised gain shouldn’t be taxed because it’s unrealised, it’s like taxing a grocery store’s unsold item.

I wouldn’t be a huge fan of taxing unrealized gains if we hadn’t been cutting taxes for the rich for 50 years. How else are we ever going to recover from that? These guys COULD have done the right thing and supported sensible taxation policies, but they didn’t, so fuck 'em. At this point it’s either this or the guillotine.

About 70 years.

What’s crazy is to calculate the average US income the census folks of the US government exclude billionaires because it would skew reality so much that people would call bullshit on the average with billionaires in the mix.

so they get to be excluded from the “average wage per family” calculations made and distributed by the government.

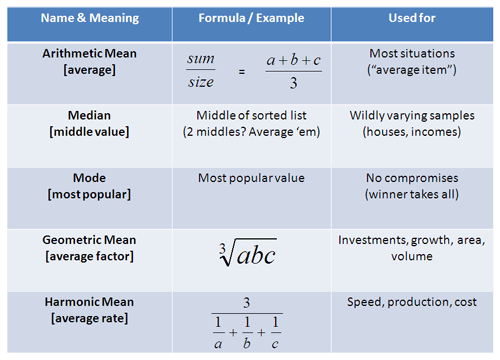

I think you’re conflating average and mean. When it comes to income average is typically median, which does include billionaires but wouldn’t skew the data due to their inclusion.

Average and mean are the same thing (sum of everything divided by total number of things). Median is the middle number.

Colloquially, average is the mean. Mathematically, average can be either mean, median, or mode.

No, that’s just the arithmetic mean. There a other often more appropriate means that can be used. Arithmetic mean is just the one most commonly taught.

I’ve never heard that, would be wild if that’s truly how they do it, I wonder what the average would be if they included the billionaire family’s.

Could I see the numbers?

Ugh. It would be so much simpler to…

… Remember those memes about what you could build with a single pandemic stimulus check? From home depot?

I don’t know man, I don’t really think building millions of birdhouses will accomplish much.

/s 😉

By pay check is unrealized gains. I still have bills to pay. Stop taxing me.

You’re not on the level of wealth this thread is about so you have nothing to worry about. Besides, your income is already taxed and in some countries it is deducted by the employer before you ever see your salary.

No shit. I’m saying its not a real gain because I haven’t deducted my living expenses like rent and groceries before my employer deducts my taxes.

TBH I’m not even considered middle class where I live but I have Unrealized Gains in the form of $VYM and Bitcoin.

I think we should tax loans where stocks are used as Collateral, or set a high bar for Unrealized Gains Tax.

The bar being talked about right now is a net worth of 100million usd, do you have a net worth of 100million? If not your bitcoin is safe.

Maybe some current proposed legislature has set that bar, but this picture of a tweet does not talk about that.

That picture is referencing Kamala’s proposed tax policy where she wants to tax unrealized capital gains on individuals worth 100mill exclusively

The tweet does not say Kamala, it does not mention “The President’s Budget” that was announced by Biden early this year, it just says that unrealized gains are not being taxed.

There is of course the implication of modern policy but I think it is healthy to include nuance and context as I have.

It’s almost like things can exist in a cultural context without explicitly defined connections.

Just say “oh, I didn’t realize” instead of digging your heels in.

Whats your problem, mate? Why is context and discussion banned in your world?

You’ll only help the liars and fiends by painting Kamala’s policy as anything other than what it is.

Says the person doing that exact thing?

That has been the baseline since the beginning. If you aren’t worth 100million there is no reason you shouldn’t support this.

There’s no reason to support it if you are worth that much.

Yeah the double negative in there

There is no beginning, Unrealized Gains taxes were enforced from the founding of this nation until the late 1960s when general properties taxes in the states shifted to no longer include intangible assets, and have been a hot topic the entire time.

If you’re referring to the President’s Budget plan announced bt Biden early this spring then thats fine. But they didn’t mention it.

Any reported bitcoin savings are unsafe because the database will get leaked. The first rule of Bitcoin is “Never tell anyone how much bitcoin you have.”

Of course, one could always just lie, but that hasn’t been even close to necessary for anyone’s safety yet.

But that means rich people will be slightly less rich. That will never happen.

Please vote for the Tax the Rich Party and not the Gut the IRS Party.

What party will actually tax the rich?

Biden also signed the Inflation Reduction Act which included IRS funds for auditing the rich.

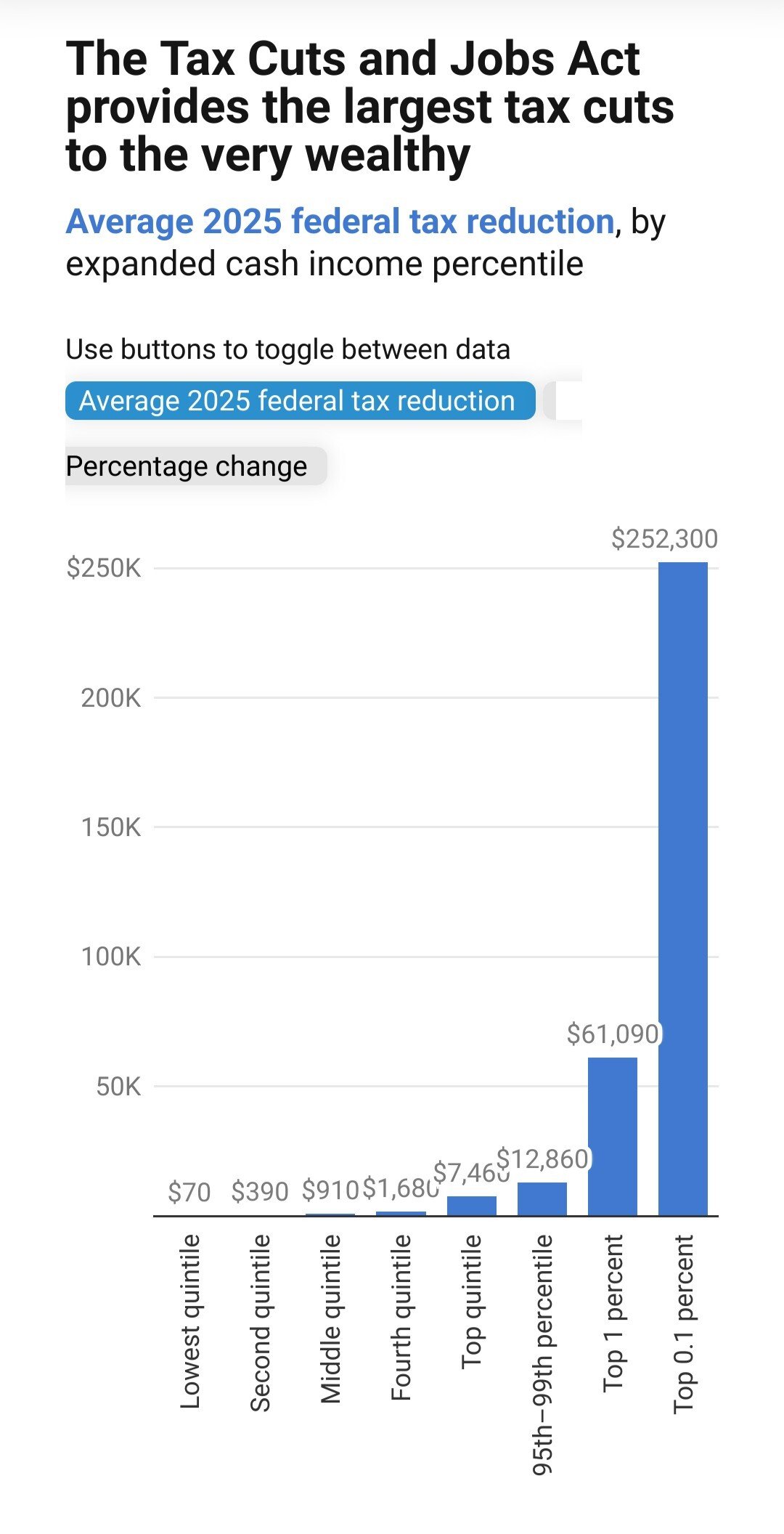

Trump’s Plan: 2016-2017 TCJA

I know the 12 year olds will be upset but this is dumb.

Unrealized gains may never be realized. If they ever are, they may be worth less at that point than the tax you paid. It is like taxing everybody on income at the beginning of the year and then telling them tough luck if they get fired and never get that income.

Also, borrowing in assets does not make you wealthier. How much tax should we charge people when they get a mortgage ( not when they sell, when they first borrow ). I mean, somebody just gave you hundreds of thousands of dollars. Why shouldn’t you have to pay tax on that? ( according to the OP at least ).

Anyway, I will stop there. We are not going to get back at the rich by saying a bunch of stupid things. If you don’t like generational wealth, fine. Have an estate tax. If you don’t like windfall wealth, fine. Have a super high progressive tax rate. I have no problem limiting extreme wealth ( it won’t hurt me ). But “tax people I don’t like on things that make no sense” just tells people you cannot think well and are not into math.

This is both a terrible strawman of advocates for this type of tax reform and a misrepresentation of what realization events are in the US tax code.

Sure “borrowing in assets does not make you wealthier” but it does provide an excellent basis for establishing increases in wealth that have already happened. Realization is a tool to avoid arguments and uncertainty around valuation, not a requirement that taxpayers have cash in a checking account to pay their liabilities. Posting collateral for borrowing inherently involves valuation so could very easily be made a realization event, it fits very neatly into existing law.

It may be a political impossibility but your dismissal doesn’t suggest you’ve really thought about it.

Also “taxing everybody on income at the beginning of the year and then telling them tough luck if they get fired and never get that income”. As someone in a high tax bracket (and state FML) who left the country mid tax year, bless you for thinking this doesn’t happen.

Both my examples are about being taxed on money that may never exist. Your second comment makes me think you did not understand me.

I am not talking about political impossibility. And I am certainly not talking about the difficulty in calculating current market value. I am talking about the poor correlation between current value and the gains that will potentially actually be “realized”. I am talking about bad policy.

Here is an example. Back in the 2000’s, there were people that were taxed on the value of their stock options using exactly this same logic ( the “value” on paper ). Later, when the market crashed, there was not even enough value left in the shares and options to pay the taxes already owing. People literally paid well over 100% tax ( in some cases hundreds of percent ). Who were these super rich people that deserved such tax treatment? Many were relatively young employees of technology companies using equity as compensation. These employees had little wealth before being taxed on their “unrealized gains” and may have been bankrupt after. The whole concept is incredibly flawed.

I personally dislike Elon Musk. But even with him, taxing him on what he was worth at the high point would be totally unjust as he is not worth that now. It makes way more sense ( in my view ) to tax him when, and if, any of that wealth materializes. I am no fan of Donald Trump. But I think it would have been totally insane to tax him on the value of his Trump Media “wealth” when it was “valued” at $8 billion. If he gets even $1 billion out of it I will be amazed. Anyway, tax him on that. Tax it at 90% if you want. But don’t tax him on “wealth” that nobody is ever going to see.

I do not know what state you are in but I am unaware of anywhere that would tax you on “unrealized” income from your high-tax bracket salary. Nobody is taxing you on the “unrealized” benefit of your salary. Are you trying to tell me that it does? Where I am, leaving the jurisdiction for more than 6 months would render my income and gains beyond that point non-taxable so the government of course wants a “final return”. Are you talking about something similar?

Again, I am all for taxing the rich. Tax actual gains however you want. What I do not think you should do is tax “unrealized” gains. It is an incredibly flawed idea.

That wealth “materializes” when his company gets a new loan based on the paper value of his assets as collateral, even if he hasn’t materially realized that value yet. If you can get rewarded with new loans and government contracts based on paper valuations, you can pay taxes based on paper valuations.

This is the thing, I think. We’re talking about unrealized gains, but I think the definition of the phrase hasn’t kept up with the practical application. If the unrealized wealth is providing tangible value, e.g. as collateral for a loan, is it “unrealized?” Seems pretty obvious it’s very realized and should be taxed as such.

I was talking about withholding, where I pay taxes that will never come due. On reflection maybe isn’t a perfect analogy.

You haven’t made a persuasive argument (or any argument really) against, you just keep insisting it’s a bad idea.

One thing that stands out is you keep referring to “money that may never exist”. That’s not how tax works. You are taxed on the basis of your income, which is often but not always monetary. This is both intuitive and consistent with existing tax code. If you don’t like it you have a much bigger problem than objecting to taxing unrealized cap gains.

If you can buy shit with it, it has value and can be taxed. There’s no need for playing “Schrödinger’s Gains” where the value is simultaneously worthless because it may/may not be realized yet it’s leveraged into material wealth of every kind. It’s like saying rich people don’t have money because it’s all tied up in assets, but somehow they have multiple homes, a yacht, and private jet trips. That is an incredibly disingenuous argument that completely sidesteps how wealth works.

Yeah it’s really very simple. That person is being purposely obtuse for whatever reason (either they have a ton of unrealized gains that they themselves have been using as leverage for years, or they believe that they are a “temporarily embarrassed millionaire” who will need these lax tax laws in the near future when they are suddenly extremely wealthy somehow).

As soon as you use those “unrealized gains” to make more money, they become realized and should be taxed. Simple.

I figured they were just another billionaire apologist.

I think they were realized, in the OP’s example, when they were used as collateral for loans, etc?

If you’re just sitting on unrealized gains, then yea maybe they don’t necessarily need to be taxed. But as soon as you use it as a means to acquiring more money, then they become realized and should be taxed.

The thing about borrowing money might be one of the dumbest things I’ve read here. Do you honestly believe that people who have access to loans (typically at much lower interest rates than us normies), etc., that it doesn’t give them 1000x more opportunity to gain more than any normal person who doesn’t have those means?

Do you actually not understand how having money makes it wayyyyyyy easier to make money?

That’s all great but then why the fuck am I paying property tax on my house that is mostly unrealized gains. Before you go arguing to abolish property tax, I’m fine with it. My property tax goes to make my neighbor better, and provide services and schooling for my neighbors.

Billionaires become rich because their companies benefit from highways, regulated internet, a public educated work force, etc… so they should pay their fare share.

Taxing unrealized gains for 99% is ok, it should be the same for the 1%.

Property tax has nothing to do with unrealized gains. It is an attempt to charge a services tax in an equitable way. It is like putting road taxes in gasoline. Framing it as a crude consumption tax would be more appropriate.

The property tax you pay on your home is a tiny fraction of its value. If we were charging those kinds of tiny percentages to billionaires you would be up in arms.

I do not have to argue abolishing property taxes because they do not introduce the kinds of brain dead distortions that “unrealized gains” taxes would. Even still, there are actually carve outs for them in most countries. Where I live, as an example, seniors can defer property tax until the property is sold ( you know, until the wealth has been realized ). As I said above though, it is really a service tax and so, even when delayed, the amount is based on assessed value every year.

If property tax was a model for your unrealized gains tax it would have these features:

- quite a small percentage of the assessed value

- the ability to defer until value had been realized

Based on the discussion here, a tax like that is not going to satisfy the mob.

Like I said, tax the rich. Tax the hell out of them. Just don’t do it in such a broken way.

Stop acting like I am defending rich people or arguing against taxes. I have been very clear that I am not. It seems equally clear that you have no rational response to what I am saying which is why you keep pretending that I am arguing for wealth inequality instead of just math. The people hit hardest by bad tax policy are always the middle class. The same would be true of a wrong-headed unrealized gains tax, no matter how much shouting about billionaires was used to make it more popular.

Maybe we’re strawmaning each other. I would be fine with a 1-2% tax on billionaire wealth that’s sitting as unrealized gains.

Taxing me on the value of my house is absolutely similar to taxing unrealized gains. If my house gained value that doesn’t mean my income did. There is no guarantee that I can afford it. I can’t sell my house to pay the tax. The same arguments used to defend billionaires applies to me as well, but somehow we’re supposed to feel bad for them but we’re ok with the middle class paying essentially the same thing as unrealized gains on the asset they own that’s mostly likely 99% of their net worth.

Can you tell me what is broken with expecting someone that holds $100b in unrealized gains to pay %1 tax on it

Using stock as collateral for loans with insanely low interest rates is very, very common among even engineers in big tech. It’s a well known loophole passed on by the older engineers/managers at the companies to the younger ones. From the perspective of eventually paying the tax it doesn’t help, but inflation will outpace the interest on one of these loans so it does lower the effective rate and more importantly for the economy as a whole is cash earned/spent without having been taxed. Ya it will need to be paid back eventually, but that can take decades.

So with a 401k loan, which is kind of this, you are limited to borrowing against it by like only up to 50% of its face value due to factors such as market volatility. And then all payments made to that loan are with alreaey taxed income, so you aren’t securing money in any way that dodges taxation.

Also using shareholdings is no different from using a house or property as collateral… property equity has unrealized value until it is sold too. One might argue you pay property taxes on that equity, but ideally, the company behind the stocks you own pays property taxes for its ownings annually, so that’s still happening. So the real problem is large companies dodging taxes due to exploiting broken tax code loopholes.

Also, i think income tax is double taxation. Businesses are the key market players in an economy so why not orient all taxation around them? Do away with personal income tax and property tax. Keep/increase sales tax, luxury tax, sin tax. And clamp the largest salary in a company to be allowed no more than 20x the average salary in the company to address wage disparities. If the CEO deserves a 1 mil bonus, the average employee deserves at least a 50k bonus. Also, no worker’s rate can be paid less than 1/20th the salary than the average employee. The more spread out the dollars are, the better it is for the economy.

You can’t use a 401k as collateral for a loan.

That’s not using it as collateral. That’s taking money out of it that you have to pay back to yourself. That means you’ll lose out on the growth in the markets that the people using their investments as collateral don’t lose.