Their tax rate isn’t the real issue. The fact that they extract that much wealth out of the labor and production of others is the real problem.

No human being should have a billion dollars. The workers who got you to your level of privilege and status should be paid based on their worth.

A boss that pays fairly would never become a billionaire, and their workers would live good lives being paid the actual value of their labor. Increased demand from increased household discretionary income would create a boom on the supply side.

But it will never happen, because billionaires own everything and will always manufacture consent. Democracy will die to thunderous applause.

Us poors (the dumb ones, because education will be forever castrated) will clap for the billionaires and lay our thrift store hand-me-down jackets over the curb so they can cross a puddle in the street lest they get a drop of water on their 100k elephant skin boots. It’s coming to a head

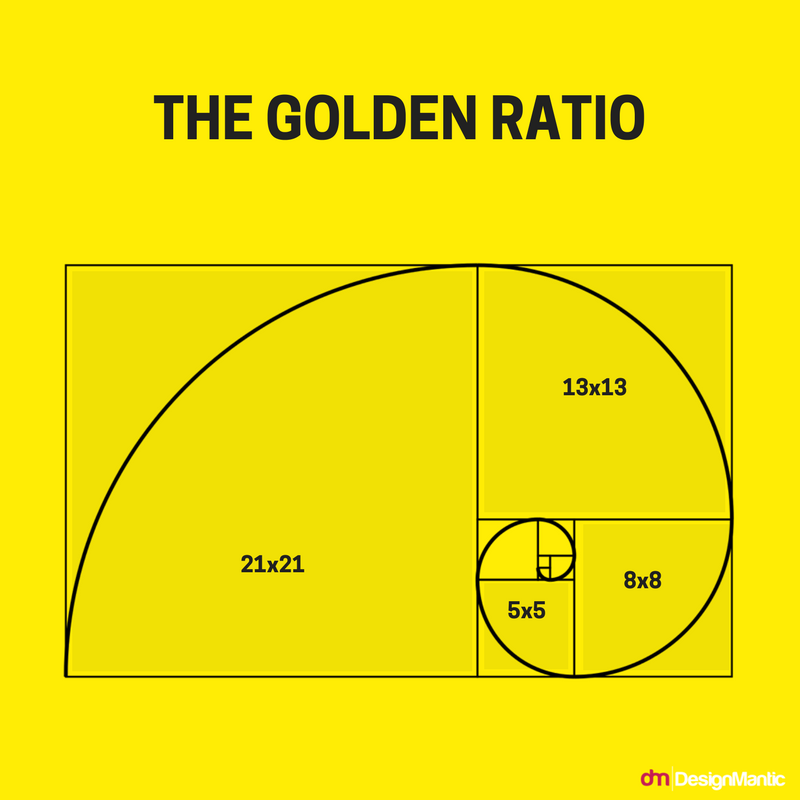

Although this is true, I’d like this graph on a billboard outside every polling location in November:

Well said.

If we tax them they won’t be incentivized to make more money, thus depriving the market of needed jobs. /s

This is true in the way they may just move overseas, but the frees up the local market for new business and competition!

OR aggressively union-bust and lobby the hell out of congress until, well, we get what we have now: corporate plutocracy.

Wouldn’t they need to employ more people to make the same amount of money?

Not in this country…

Just like we never should have bailed out corporations we should not worry about taxing corporations or the rich. The void will be filled and more rich people will be made. That’s how the “free market” works. If you do not let companies die innovation slows and the economy rots. Rich people may not be motivated but some poor people will be.

That there are even billionaires, let alone multi-billionaires. It’s an immoral, unethical system that fundamentally exploited labor that allowed for this.

That productivity has gone up but wages have remained stagnant should boil everyone’s blood. All the wealth stolen and sent upwards into fewer and fewer hands. Legalized theft by way of capitalism.

Great article. Nice to see an economist doing such important work. I don’t really understand finances. I snipped the parts of the article that helped me understand the finding/headling. There’s a great chart in the article of taxation differences since the 1960s too - staggering! Plutocracy in action!

Published in The New York Times with the headline “It’s Time to Tax the Billionaires,” Zucman’s analysis notes that billionaires pay so little in taxes relative to their vast fortunes because they “live off their wealth”—mostly in the form of stock holdings—rather than wages and salaries.

Stock gains aren’t currently taxed in the U.S. until the underlying asset is sold, leaving billionaires like Amazon founder Jeff Bezos and Tesla CEO Elon Musk—a pair frequently competing to be the single richest man on the planet—with very little taxable income.

“But they can still make eye-popping purchases by borrowing against their assets,” Zucman noted. “Mr. Musk, for example, used his shares in Tesla as collateral to rustle up around $13 billion in tax-free loans to put toward his acquisition of Twitter.”

We can tax registered securities. Stock holdings. We can take 5% or 50% of all outstanding shares, each and every year, and transfer them to IRS liquidators to be resold in small lots over time.

We can exempt the first $10 million held by a natural person, (which exempts about 99.5% of the populace from the securities tax) and establish a progressive tax schedule that causes the tax rate to exceed average gains when holding more than $100 million worth of securities.

Removed by mod

You are familiar with the concept of democracy, are you not?

Removed by mod

First Tuesday after the first Monday in November.

Removed by mod

Removed by mod

BREAKING NEWS: Republican voters still learning about the Trump Era Tax Reform 8 years later!

Exactly my first thought seeing the thumbnail

Probably get banned for this, but it’s worth it.

Sometimes I think we shouldn’t have photoshop.

Then I drink more 🖖🏻

I…I mean the original is amazing…one of the best moments in television history…

But you went and made it better somehow.

One of the things I do love about Lemmy is that any post anywhere can suddenly turn into a Star Trek shitposting thread

NOONE EXPECTS THE STARFLEET INQUISITION

(one of you nerds make that into a gif)

Yeah, I saw that, but forgot to bookmark it

(before I get flamed… I like both series for what they are. But, uh… yeah. Spock wants his Lightsaber, too.)

Sisko is the best captain.

Hands down. He tko’d Q… and lived to tell about it.

I woke my dog up laughing at this

Damn, beat me to the punch!

What the MSM considers normal regular American I consider upperclass. What they consider poor I consider normal. What they consider homeless is actually the new poor.

Yeah, a whole lot of working folks are one missed paycheck from homelessness. I’m old enough to remember that it wasn’t always like this, if you were working you didn’t have nearly so much anxiety and exhaustion, you could afford to look after a kid or have the occasional holiday, maybe own a home. Not anymore. The rich are getting richer though.

I’ve watched some of my friends struggle with homelessness. They are amazing people with brilliant minds, but just got unlucky while working a dead end job. It’s fucking terrible.

Yeah, it’s really messed up. And getting worse. I’m just not sure how we change it without violence though. Voting doesn’t fucking help. And, like me, most of the people who are hurting don’t want violent change. Rightly, because like capitalism, revolution hurts a lot of people. But it feels like society is a balloon and the rich are squeezing it and wondering when it’ll pop. It’s hard to predict what’s gonna happen but based on the way things have been I’d say worse.

A general, mass strike would probably never happen. But it should. More strikes in general. I feel like there are still things to try before going full Joker

I think torches, and pitchforks. We should go old school.

I wish people would say this and mean it. I’m waiting. I think we should actually eat one billionaire to make a point. I’m vegetarian but I’ll take a bite to prove my commitment.

deleted by creator

I’m not a fan of developing neurological disorders, but I would feed Musk to some literal pigs.

EDIT: The Sacklers First.

Okay, but who do you think would taste the worst?

deleted by creator

It’s kind of a naive idea though. I used to think it was possible. They will literally just kill us or actively make us poor/homeless/antisocial and make some sort of loophole to make it legal and justified. I wish I didn’t think it was game over for the nation but I think it’s actually a lost cause. And any time I try to talk to someone in hopes they can influence me otherwise they just prove my point and make me want to give up more. It’s like they create a division on purpose, or the benefit of the doubt is that they are too naive or emotional to understand what they are actually doing which is creating more of the people they claim to oppose.

It’s like a natural force that keeps war in constant motion. Nobody is allowed to just “be”. Doesn’t matter if they contribute to society or not. People are disposable to groups and nations. It’s an industry. Probably the one that maintains the backbone or foundation of each group/nation/force.

This is exactly what they want you to think. But the republican party is almost at the point where they can’t win a national election even WITH all thier gerrymandering and misinformation. 2024 may be the last election where they even stand a chance.

The ultra-rich want you to believe that it’s hopeless, but it is far from it. Their only options now are to create a dictatorship or give up political power to the left, who (however flawed) actually represent the people.

When I watched the movie “V for Vendetta” as a kid, I thought it was inspiring and dramatic.

Now I see it as ridiculous. At the end, when the protesters are facing the armed soldiers? And they just stand down? Yeah, that would not happen. There would be a bunch of bullet-riddled corpses in masks. And then the next day, the executions would begin.

This is easy to solve. Count the loans as ordinary income. Problem solved.

I had to take an insane amount of loans out to get my nursing license. I’ll be paying them off for over a decade. I don’t like this idea

Easy, put a 1 million dollar limit (as in tax kicks in after 1 mil)

And exclude primary residence.

Imagine being being able to afford a residence

eexclude value of average (maybe median) cost of a dwelling off their dwelling.

fuck this “my primary dwelling is a $10m mansion”

Update the new personal exemption to 50k. 12.5k is no longer the poverty line.

There are numerous things to make this proposal reasonable.

Count as income depending on amount of loan, nature of collateral, and usage of the loaned money.

A loan taken out against primary residence used for purchase of same residence under a million dollars? Not applicable. Proceeds used for education, within reasonable limits? Not applicable.

When a loan is taxed as income, provide for tax credits upon repayment reconcile ultimate use of “real” income. That way you avoid the “double tax” compliant they keep whining about.

I find the tax loans approach ultimately the most workable approach to close the loopholes.

Exclude students loans and anything tied to an asset. These are unique loans only offered to the super wealthy or since there are equity based loans, just tax equity based loans

Aren’t all loans tied to assets?

No.

That rich get loans that basically last their lifetime. They are income replacement. They are not tied to home, a car, etc.

They are just avoiding taxes.

I don’t blame them. It’s smart.

It’s why politicians need to eliminate it.

And it’s tied to an asset. Stocks, real estate, something. That’s how loans work. The bank doesn’t just hand you money just for an IOU. It needs something to hold you accountable.

No it’s not. They are not buying an asset with. It’s sometimes back with with an asset as collateral but it’s not tied to an asset. The loan isn’t taken out to buy a home. It’s taken out as living expenses.

It’s why a consumption tax would fuck the rich.

Oh, you mean as the destination of the money. But I wouldn’t be too quick to use this as criteria. Lots of people use loans like that because they get poor. Think HELOC, reverse mortgages,… Having a minimum value below which you are exempt seems much better.

Loans to entities with more than 10 million net-worth then.

Or just make loans taxable, doesn’t have to be the same as income- like capital gains tax.

Capital gains is much lower and doesn’t pay into SS, Medicare, etc.

Sounds like we could fix that too.

My point is, it doesn’t have to be “income tax”, it could be its own, much more painful tax.

(Who am I kidding, enough senators live off this stuff too.)

Taxes are not supposed to be painful. They are supposed to be fair and fund the government. Painful taxes just causes avoidance.

Tax avoidance is a crime.

Lock up the billionaires. I see nothing wrong with it.

That’s the difference between tax avoidance and tax evasion. Avoidance is legal, evasion is not.

Tax avoidance isn’t a crime.

Do you use deductions on your 1040? That’s tax avoidance.

No, count unrealized asset value as income.

You gained 2 billion in stock value, but didn’t sell? You get taxed on that stock gain.

I can’t support that. I myself once had 20 million in stock options but couldn’t sell it. By the time I could sell it, it was worth zero. Yet you in your system I would have paid taxes on it. Stock fluctuates in value to much. We just need way to force them sell the stock and then tax the stock as ordinary income.

Once it went to zero, it would have been a loss and canceled out?

Well if I had to pay unrealized gains I’d have zero but have to pay taxes on 20 million.

It’s why we don’t do it. It would be overly complicated.

No, you would pay taxes on the unrealized gains of your assets. So if your assets are worth 0, then you pay 0. If they are worth 20mil, then you pay taxes on 20mil.

Just a quick reminder, one of the main principles of capitalism is risk vs reward.

That’s my point. They were worth 20 million. Due to legal restrictions I couldn’t sell. As such I would have to pay taxes on 20 million. When I could sell they were worth zero.

So I would have ended up negative.

Sounds like that stock wasn’t worth the risk then. That’s capitalism in a nutshell brahski, people lose money betting on the market every day.

So only corporations and billionaires can afford to own a home?

Pretty sure that is not what I said. Anyway, you are already taxed on the value of your home on a yearly basis, regardless if you sold it or not. Take your ball and go home.

What he is saying your home is an unrealized gain which is true.

While we pay property taxes they are a small percentage and based on the tax value and not the fair market.

While not a fan of property tax they at least directly impact you by providing value to your local area. Why I don’t bitch much about property taxes. I’d rather pay those than federal taxes.

You’re not taxed on the full appreciation of your home at income tax rates. If the government did, the tax on the appreciation would price people out of their homes.

Really? We should let the people in the low income areas of my city that just saw their valuations jump up know, because that is exactly what is happening to them. Property value went up 300%, so did the taxes.

Ah. I failed to consider you live outside of the United States of America. I’m sorry that low income earners are burdened by this kind of tax policy.

Wrong

Removed by mod

for the first time

Nobody ask about the long-term capital gains rate going back to Ronald Reagan’s '83 reform.

Not 100% sure but I imagine they’d count capital gains in the analysis. The full read in The NY Times was interesting but behind a paywall

I imagine they’d count capital gains in the analysis

https://lemmy.blahaj.zone/comment/8544719

The NYTimes analysis is just about income taxes

Aren’t you contradicting yourself here?

Not really. Other forms of taxation significantly differ, whereas capital gains are taxed based on how much you made, like income.

Tax the rich, the banks, and the churches. Then see if you still need anything from the normies.

Removed by mod

But it isn’t for the first time. This has been happening for years

That analysis you linked isn’t about income taxes. The NYTimes analysis is just about income taxes. It is the first time, although the report is on data that’s a few years old

Yeah I know, it is about the total effective tax rate of various income levels. It clearly demonstrates how the ultra ultra wealthy are able to pay less tax. In theory we are supposed to be on a progressive tax system. In reality at a certain income level it becomes regressive. Just focusing on income tax regardless of the rate. Will never show a full picture. There are other taxes that everybody pays. It is much more telling to understand how the whole package works instead of just focusing on one part.

And that is without tax loopholes and evasions. The ultra wealthy have more than enough money to pay the accountants and tax lawyers needed to under report their income.

They used to push for a flat tax where everyone, billionaires and minimum wage workers alike, would pay the same rate. They did one better and now billionaires pay a lower rate than everyone else. Steve Forbes was an idiot. They managed to do it far better than he could have ever imagined when he ran for President in the 90’s. Fucking nepo babies…

Flat tax is an awful idea.

Say they make it 10%

When you make $30k a year, $3,000 has a much higer impact on your finances than someone who makes $3,000,000 and pays $300,000 in taxes. You keep $27,000, they keep $2,700,000. You lose a mortgage payment and a car payment. They have to buy a slightly smaller yacht.

On top of that, as already mentioned, their wealth comes from stocks and other non-wages income. Bezos famously only took $81,000 (I think?) in actual pay for many years, yet he’s one of the richest people on the planet. You think $8,100 in taxes is good enough for one of the richest people while you pay $3k out of your $30k?

Flat tax is a bad idea, and the only ones who want it are the wealthy and those who don’t understand that the wealthy could take whatever salary they want to pay as little tax as possible and just live off stocks, loans, which is how they already avoid paying taxes.

deleted by creator

Have a flat tax based on brackets.

5% for x income 10% for x income Top out at 30-40%

Problem solved

I think you forgot the /s or some people won’t get it. Also it should go back to topping out at 90%

A 30% flax tax is higher than the mythical 90%.

The 90% range had so many deductions only 1 person hit it and even then it’s only on the income that exceeds that limit.

A 30% flat tax with no deductions is much more brutal to income but it’s fair.

Ahhh you aren’t using the current definition of “flat tax”. Flat tax is a single rate across all incomes. It still includes deductions, exemptions, credits etc.

I don’t know the correct term for “no deductions tax”. No exceptions? Non adjustable?

Your bracket concept is how it works now.

Flat means no deductions and an equal pay. It can still be done against brackets and be a flat tax.

No brackets work with credits and deductions. Someone with 100k in income could pay zero in taxes. A flat tax makes them pay taxes by removing deductions.

Personally I’d rather see a consumption tax but that freaks most people out.

“A flat tax is a tax with a single rate on the taxable amount, after accounting for any deductions or exemptions from the tax base. It is not necessarily a fully proportional tax.” Wikipedia

I agree that flat tax is unfair, but flat tax with no deductions would be better than current inverted scale where rich pay smaller percentage.

I don’t think you understand.

If flat tax would apply evenly to all sources, investment sales taxed at same rate as wages. No deductions. How would this not be fairer than the US current tax scheme?

You didn’t read what I said?

If a billionaire can take a salary of $80k at the hypothetical 10% tax and pay $8k tax while an IT professional making $200k has to pay $20k how is that fair? The billionaire takes money from capital gains (lower taxes) because they pay themselves in stock and funds, and/or uses loans (zero tax on loans- you know that, right?), puts his yacht under a shell company so no personal taxes on that, probably uses it for business trips so it’s use can be written off partially…and buys whatever the hell he/she wants. But pays less tax than the IT professional.

So you’re saying that’s just fine. That’s exactly how a flat tax works. That’s how rich people pay less than regular people.

No I do not think it’s fine. I did read what you said, but from your reply it’s obvious you didn’t read what I said.

I said if “apply evenly to all sources, investment sales taxed at same rate as wages” From your reply “billionaire takes money from capital gains (lower taxes)”. That’s not the same rate is it.

I said "No deductions."From your reply “so its use can be written off partially” That’s a deduction isn’t it.

The current system where rich pay a lower tax rate because they can take advantage of things like capital gains and deductions is not fair or equitable. A flat rate system that eliminated things like capital gains and deductions would not be fair, but it would be fairer because it keep the millionaire mfrom paying a lower rate than the poor (or the software engineer).

Graduated tax that eliminated things like capital gains and deductions would be fairer still. Also gift exemption, inheritance exemption and other carveouts that unduly favor the wealthy should at least be be adjusted if not outright eliminated.

Because a business use of a yacht (hypothetically) is not income. You get your yacht but no worries about it being taxed as income. You also completely skipped loans, loans are not income and therefore not taxable under your scheme, and portfolio loans are a huge part of how the wealthy get spending money. Now before you reiterate yet again you said all sources I want you to think a minute that these taxes are going to be applied to you, too. Your 401k. That’s investment. Your home loan. You want to tax that? How about your car and student loans. More taxes? Still sound right? Do you want to make carve outs for those things? That sounds suspiciously like writeoffs or “deductions”.

We could sit here all day and quibble over what is and isn’t income, but at the end of the day you’re going to end up with exceptions, or “deductions”, and if you’re going to say “well, nobody making under ‘x’ amount should be taxed on a 401k…” and now we’re right back where we started with a rich person making less than ‘x’.

Flat taxes are not going to work.

They are not fair.

You need a wealth tax and you need a tax that attaches itself to the vehicles used by the wealthy to get money that is under- or not taxed. Tax personal or portfolio loans over 100,000 not used for housing, medical care, or education. Stock options issued in lieu of or along with salary as compensation should be taxed as income when sold. Do not tax individual personal retirement accounts that deliver less than “x” income or payout to persons of retirement age. This is how you tax wealth and protect the normal persons. Not 10% of the $81k salary the billionaire gives himself.

Trump has said if he’s elected he’ll lower the tax rate for the rich even more.