- cross-posted to:

- [email protected]

- cross-posted to:

- [email protected]

Just ban corporations from owning homes for “investing”.

Also make a cap on the number of single family homes one person can own. Rent is for apartments.

Eh, instead of a ban an exponentially increasing tax would probably be just as effective a discouragement and better account for weird edge cases.

For every house beyond 2 houses, it taxes all of your houses 20% of the value of the house per year.

3 houses: 20% each

4 houses: 40% each

5 houses: 60% each… and so on.

I would agree with a cap of 2 detached houses per person/couple.

Rent is not just for apartments, some people have families and need to rent as well, due to work and other life conditions. Can’t easily house 2 adults and 3 children in an apartment.

This, but the government also has to be active in closing loopholes as people discover them, and make sure people know that’s their plan.

I’ll would have preferred if they did a reverse scale system based off of use. Everyone get taxed and they can claim the biggest credit if it’s primary residence. All proceeds would be used to fun co-op housing.

- Primary residence

- Rental (offset by income)

- Just left empty.

I would also imagine people with only primary residences would actually paying even less than they do now. Just to sell them on the idea.

Pretty much agree with everything you’ve said here, but I just wanted to say that

All proceeds would be used to fun co-op housing

I am 150% for fun co-ops.

I appreciate the effort, and I think this might be good legislation. Not sure yet, but it’s worth to try and see.

That said, I don’t really know if house flippers are really “speculators”. I don’t see speculation involved in arguing that a house is worth more after renovation.

The days of “flippers” being “renovators” is long gone. The model now is to buy them for 30% less than they would probably bring on the fair market by straight-up lying and telling homeowners that realtors fees and time lost (ie: doing showings) are equivalent to the difference (they’re not, not by a long shot), then turning around and posting the same goddamn properties (using realtors, natch) at their full market price and clearing the 30%.

The world is full of impatient idiots, so naturally this is a profitable business model. If you don’t think it’s profitable, then I invite you to look at all the ad money spent on “I’M DICK FUCK THE HOMEBUYER AND I WANT TO BUY YOUR HOME” ads, articles, text messages and spam emails. You can’t spend that kind of money on marketing and not be a goddamn insanely profitable legal scam.

Sounds fair, but negotiating purchases below market values - even if at a grifter level - is still not speculation either. Making a profit off of “impatient idiots” is at best shady arbitrage, it should still be resold near market value anyway.

This seems like a potential minefield of unintended consequences. Flipping might contribute to higher house prices, but flipping usually is done by flippers looking to repair run down houses to sell at more or less market prices. If they can’t afford to do that, won’t it mean less avenues for those wanting to get out of a mess? Or even flippers turning landlords long enough to avoid the tax? Am I missing something?

It should convert to lower prices overall because the market inventory wont be snapped up by flippers trying to turn a quick profit. Leaving more choices on the market

flipping usually is done by flippers looking to repair run down houses

This isn’t really the case. Yes, a lot of it may be on really run-down houses that are upgraded to decent or nice, it’s actually pretty common for flips to be cheap and decent houses turned into top-of-the-line. Flipping almost always prices out lower/middle class incomes.

More importantly, it will eliminate the requirement for every goddamn house on the market to go for a full-cash offer.

Really run-down houses will have lots of room for profit as they buy them for cheap and invest in renovating them. Taking 20% off the top just alters the economics of it, and leaves it for someone who would buy the house to repair/renovate it so they can live in it.

I would love to buy a run down property and repair it myself to live in, but they are all unaffordable because the owners know flippers will buy it for 50% markup and then repair it and sell for another 50% profit to someone who doesnt have the skills to repair it themselves.

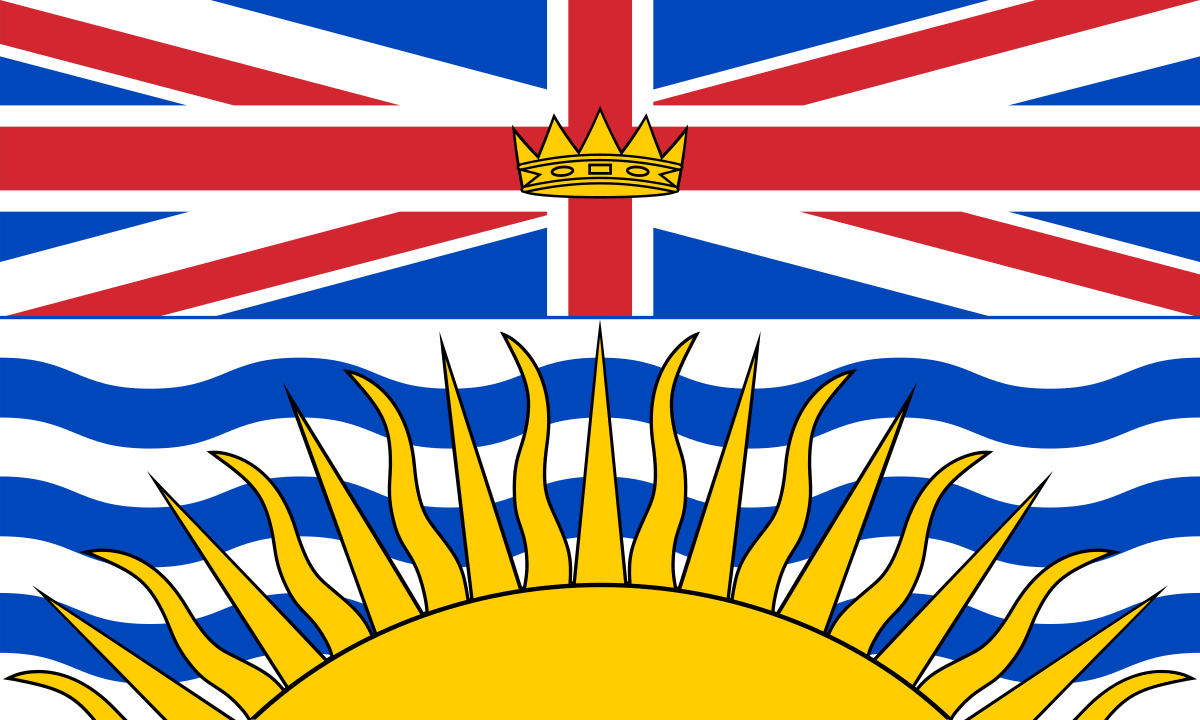

BC will literally do everything except address the ‘Oops! All rental properties’ problem. We know you’re all a bunch of landlords, but stop logging forest just to build more rental properties and start filling the existing ones with permanent homeowners.

The province will finally decide to go against rentals as soon as I decide to buy a property. I’ve been waiting forever for the bubble to finally burst but it won’t until I buy something.

Capitalism will end long before the caucus of landlords decides to give up their rental properties.

The Ministry of Finance estimates the tax could generate about $43 million a year in tax revenue.

What could go wrong you ask? It’s right there… $43m a year… That doesn’t get deducted from the profits of the speculators, it comes out of the equity in the homes that get sold. The flippers aren’t gonna eat the tax, they’re going to add it to the cost of the homes they flip.

The law isn’t going to mitigate flipping much, it’s going to add $43m/year to the amount home prices increase by, and when people see the neighbors house values go up, they’ll demand more for their non-flip sales as well.

It doesn’t take a mathematician to realize that a 20% price hike every time a home is sold is an impossibility. It will absolutely have an effect on flipping volume and turnover duration.