One of the funniest scenes in internet history.

At first, I was like, “Who cares? Land property ownership as an investment vehicle is part of the problem in the US,” but then I realized that this article isn’t for people like me. This is an article meant to reach the Gen Xers, the Boomers, and others who think they don’t have to care, because their property will keep them wealthy enough to avoid the worst Climate Change has to offer.

And if threatening people’s wallets is what it takes to get people to see the inescapable danger in doing nothing, then I’m all for it.

This will affect renters too if you were implying otherwise. It’s just NYT doesn’t cater to those people so they’re barely mentioned.

It absolutely does directly affect renters, maybe they could have explained why, but it’s relatively obvious: Renters need to pay for owners mortgage interest, insurance and property taxes for owner to be in landlord business. His profits are the expected annual positive home appreciation.

Propublica link to the same article

No offense to op but I think they deserve the clicks more than NYT

NYT has been trash for a while, sadly, thanks for the alternate link.

Climate Change? Not the concentration of real estate into the hands of the few who no longer make profit from owning it?

K.

Edit: let me add more to this; if it wasn’t climate change, it would be something else. It’s a bubble. If you aren’t aware of this you’re either quite literally living under a rock, or don’t know how graphs work. Housing prices have simply gone up while wages continue to stagnate and housing supply has been artificially reduced.

Don’t, and will never, own a home due to greedy landlords.

Don’t care.

This will still impact you and in ways that will be immediately apparent. The loss of houses means that those former home owners will have to find new property to purchase - only to see the same astronomical price tag you see. So they become renters. That sudden impact on the demand for places to live will find apartments and landlords can now find many more people, some very desperate with a lump sum of a settlement or insurance payout (but not enough to buy another home), that will pay much more than you can. And they don’t budget well, which is why they lived in a poor state that flooded so much insurance companies got scared, so they spend way too much without consideration for how long they can afford rent at such high prices.

But hey, you are right about greedy landlords.

Don’t, and will never, own a home due to greedy landlords.

Not sure if you typed correctly. Owning a home is an escape from greedy landlords. Maybe you are saying you will always be poor due to greedy landlords?

Mehh

The issue isnt that house values will decline, they will decline whether we act or not (it will neither be linear, nor be applied equally)

What can happen is it won’t be as bad if the decline is managed as best we can, rather then the inevitable unmitigated mess if we just keep doing what we’re doing now. Alas that’s the path weve chosen.

Some of the problem here is theres no recognition of a job well done (managed abandontment, reduced emissions etx), the irony is the ones making the mess who respond the best to the disasters, get most of the accolades. Like Taykor Swift donating to an LA fire charity.

No countries are supporting banning flying, banning new road building and only building PT and cycling infrastructure etc etc so the mess can only get worse as we bury our heads further up our own ass and gaze upon the unholy mess we created (pun intended)

You guys own homes?

Seems like the nomads had the right idea.

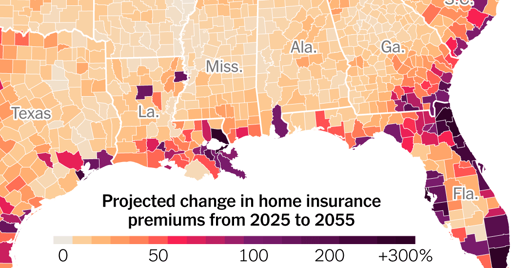

Average premiums have risen 31 percent across the country since 2019, and are steeper in high-risk climate zones. Over the next 30 years, if insurance prices are unhindered, they will, on average, leap another 29 percent,

More likely, over next 6 years will match increase since 2019. Taxpayer subsidies of insurance doesn’t count. Neither does Florida type “deregulation” which makes it easier for insurance to avoid paying claims.

Other quote from article is that insurance is now 20% of a mortgage payment. A 30 year amortization at 5.31% means total interest payments equal to loan. Current interest rates are about 2% higher than this. But historical home appreciation is 3%, and when mortgage rates are above 3%, then you fundamentally expect to lose money except for the distortions of taxes on interest payments vs rent. Rent avoidance + interest tax credits can still make ownership attractive, but at least balanced long term vs rent alternatives.

That 20% of mortgage payment though is equivalent to 1.33% on full home value. Up from 0.5%. OP is projecting it will rise in some parts of the country to over 5% of value. Which is about right for what used to be 500 year events happening less than every 10 years. Insurance could go up much quicker and to higher levels since global warming means even worse than current disaster levels.

But the expectation of historical 3% annual home appreciation, goes straight to 1.5% depreciation expectations when insurance goes from 0.5% to 5% of value. Construction cost inflation is also insurance (because of “value” and replacement cost) inflation. Home prices are currently overvalued due to high interest rates making people not being able to afford trading up in homes due to high mortgage costs, and so not selling their home, limiting supply. Very low new construction levels due to same effect. One effect of mass deportations is lower home values due to fewer tenants, while also keeping interest rates high due to less cheap labour availabe, inflation. Tariffs/war on Canada means vast Canadian 2nd homes in US up for sale.

Housing depreciation will cause banking collapses and recessions, leading to more housing depreciation. Bankster bailouts (banks are the important people) reduce US financial credibility even more, and even higher interest rates to depreciate home values more with more bank bailouts.

If we ignore the problem long enough, surely it’ll go away, right?

luckily all the value increase of the last decades has just been false really. Its not losing value as much as returning to its actual value.

I countered this by adding a pissing cherub fountain to my landscaping. It’s called “curb appeal”.

Overlay a county granular map of new housing starts in 2024, with a map of home insurance premiums rising, and you’ll likely soon see yet another way the entire US housing market is an outright fucking scam.

There are some exception areas, but basically?

Pretty much all the new homes are being built in areas that are expected to basically flood or burn down or be without utilities from blizzards or massive drought/heatwaves continuously, moving forward.

Efficient Market Hypothesis Confirmed.

I mean, this has nothing to do with climate change and more to do with insurance companies raping every dollar they can out of people’s wallets. They would have been doing this anyhow. These areas were already getting hit annually with hurricanes, tornadoes, etc.

Insurance companies are pulling out of home insurance markets in certain states because climate change has made them uninsurable. Many places are facing things they rarely if ever witnessed eg I have seen more tornados in NJ, which most years sees zero tornados, from 2014-now than from 1974-2013.

Climate change is real.

Climate change IS real…but it’s not why these insurance companies are doing what they’re doing.

Did you think I was denying climate change or something? Do you really live your life like this? Thinking that everyone is out to deny basic realities?

Today’s “Tornado Alley” isn’t seeing any insurance rises in that graph, so your anecdotal evidence doesn’t even play out.

Insurance companies have historically always announced pull-outs in areas that have been hit by weather disasters. This isn’t new.

I live in America where climate change denial is common. You made a comment about how this has nothing to do with climate change and this is about insurers screwing people out of money. That’s not correct IMO but can you see why I thought you were engaging in denialism?

It IS about insurers screwing people out of money, because historically they’ve ALWAYS done this. Any places ravaged by disaster they pull out of, raise prices on. This has been a commonality since the advent of insurance agencies.

This is a very Correlation != Causation argument here. Not denialism.

No? That’s actually fairly recent. Unless you live in a declared disaster zone you typically could get insurance. Entire states being uninsurable is new. Insurers are pulling out of states like FL and CA because they could not afford to cover the claims when another disaster hit.

This has more to do with the incredible cost of housing rather than climate crisis though. Yes, the frequency of these things is increasing - but NOT anywhere near the same degree as property values skyrocketing and causing the ‘repair cost’ to go up as well.

I understand that in the long run, it’s a good thing to attribute this to the climate crisis - so long as it gets people to change their habits, it could be considered morally righteous.

But the factual reality of it, is that climate doesn’t play a large part in the reasons for them doing this. And I, for one, am tired of living in this reality where things are just convenient, but not necessarily true. I am very scientifically minded, and I thrive on information being correct and accurate.

It’s both? The insurers still cannot afford another massive hurricane around Miami.

This isn’t insurance companies, the LA fires alone cost $250 billion, ~the gdp of new Zealand. Even if we abolished insurance companies someone’s gotta pay for that. In that vein a lot of insurance companies are abolishing themselves, either going under or just leaving the state because Californiais a net loss to most companies, not a profit. So more people go on state insurance which is very expensive, not because the state is “r*ping you” but because it’s a pool of houses highly likely to be burned down or flooded in the next decade and you have to have high premiums to cover that.

The problem is climate change and the increasing disasters it’s causing. The article even says that premiums are still too low to account for this.

First Street found that today, insurance underprices climate risk for 39 million properties across the continental United States — meaning that for 27% of properties in the country, premiums are too low to cover their climate exposure.

The LA fires “cost 250 billion” because of the stupid inflation on a buildings value. It’s as simple as that.

All policies have nothing to do with climate change more to do with companies raping every dollar they can out of people’s wallets. That includes the C02 tax scam.

Especially the “Carbon Sinking” efforts where people are claiming they’re taking carbon dioxide and pumping it deep underground. That shit’s such a fucking scam and a half…