Absolute bubble for the datacenter middlemen and the AI software behemoth models that need data centers. The hardware companies though, and AI/LLMs overall, are here to stay and even if they waste their profits on investing in middlemen/datacenter/software customers, they can be profitable by inflating costs of their GPUs/hardware.

GPU depreciation matters, but tends to be relatively slow due to controlled incrementalism in hardware. Still, the high end faces the most risk, and Huawei/Alibaba won’t be satisfied with small share gains over Nvidia to keep pricing gains. Even AMD is improving software stack fast enough to make affordable private AI. The low end has signficant disruption potential to the fossil powered datacenter/Skynet model.

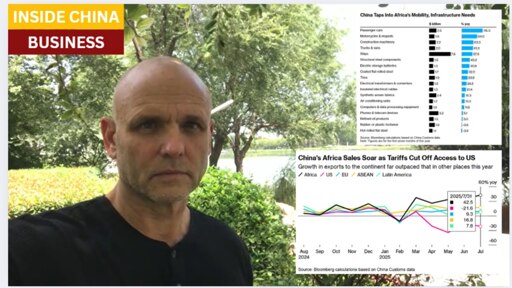

It’s not just an overall stock market bubble, it is a US GDP bubble. Where datacenter growth $ is larger than consumer spending growth $. Skynet for Israel control spending is an unstoppable corruption vector, and yes the champions of Israel must be financed and supported as geniuses by all media or “China and Iran will win.”

The nuclear industry likes to lowball the cost of SMRs (heart of nuclear ships), but the overall cost difference of power types is the truth. Aircraft carriers are also 4x the cost of diesel, but with only 2x the operational costs (inclusive of similar functions of managing planes). An aircraft carrier requires 1000 extra crew to supervise the reactor.