MxWarp

- 77 Posts

- 37 Comments

Questrade: 726233672427171

Tangerine orange key: 65387526S1

Wealthsimple, T3LQRG https://www.wealthsimple.com/invite

Simplii(No Fee Chequing Account, High Interest Savings Account, Personal Line of Credit, and Cash Back Visa Card), https://blue.mbsy.co/6sT2q8

Simplii mortgage, 0009478895

Looks like they finally got the memo!

While it might not directly relate to Canadian Finance News, I believe we could implement a similar regulation for big banks in Canada. Currently, none of these banks have raised their deposit interest rates, and I think this practice should become the standard.

Yes, According to a recent article and insights from University of Ottawa law professor Michael Geist, who holds the Canada Research Chair in internet and e-commerce law, it becomes evident why Australia was successful in striking a deal with Facebook to retain news content.

21·3 years ago

21·3 years agoGood bot

2·3 years ago

2·3 years ago“Cyclospora infection can occur due to eating contaminated, imported raw produce, especially leafy greens, fresh herbs and berries. Locally-grown produce is not known to carry Cyclospora,” the BCCDC said in a release.

The parasite is commonly found in tropical and subtropical areas, including Peru, Cuba, India, Nepal, Mexico, Guatemala, Dominican Republic, and Southeast Asia.

Symptoms of the illness can include diarrhea, abdominal cramps, nausea, and vomiting. Some people also experience a fever.

“One thing of note is that the diarrhea for cyclospora can last for quite a while — [it] can last for a few weeks,” BCCDC public health physician Dr. Mayank Singal said.

EQB.TO to the 🚀🌕

2·3 years ago

2·3 years agoAlthough I agree with the sentiment, I believe that checking your credit report only once a year leaves too long of a gap, especially in this modern age of rampant identity theft and frequent data breaches.

I strongly advise everyone to sign up for Credit Karma & Borrowell, which allows you to check your credit score and report every month. These apps also provide helpful notifications for significant changes in your score, helping you stay vigilant against potential threats.

3·3 years ago

3·3 years agoAMC Entertainment Holdings, Inc. is an American movie theater chain founded in Kansas City, Missouri, and now headquartered in Leawood, Kansas.

It is the largest movie theater chain in the world, owner of 940 theaters and 10,474 screens

Developer name for Raivo has been updated to Mobime on app stores, https://apps.apple.com/ca/app/raivo-authenticator/id1459042137

2·3 years ago

2·3 years agoWealthsimple now offers 4% for ALL Cash clients

Previously: 1% for all clients, 3% for direct deposits over $500, 4% for $100,000 net deposits

Now: 4% for all clients, 4.5% for $100,000 net deposits, 5% for $500,000 net deposits

1·3 years ago

1·3 years agoWealthsimple now offers 4% for ALL Cash clients

Previously: 1% for all clients, 3% for direct deposits over $500, 4% for $100,000 net deposits

Now: 4% for all clients, 4.5% for $100,000 net deposits, 5% for $500,000 net deposits

Wealthsimple now offers 4% for ALL Cash clients

Previously: 1% for all clients, 3% for direct deposits over $500, 4% for $100,000 net deposits

Now: 4% for all clients, 4.5% for $100,000 net deposits, 5% for $500,000 net deposits

2·3 years ago

2·3 years agoThank you for your input! I didn’t realize that net worth in stocks, GICs, HISA & registered accounts could be considered eligible assets for borrowing in Canada, which is fantastic. I’m definitely going to look into this further.

Regarding Interactive Brokers, I have some reservations about their management style, especially after their chairman, who is also their largest shareholder, criticized retail investors during the GME short squeeze, suggesting that normal people buying and holding a stock and causing a squeeze is manipulation. It makes me question their trustworthiness.

I truly appreciate your insights and find them enlightening.

Thanks for sharing!

2·3 years ago

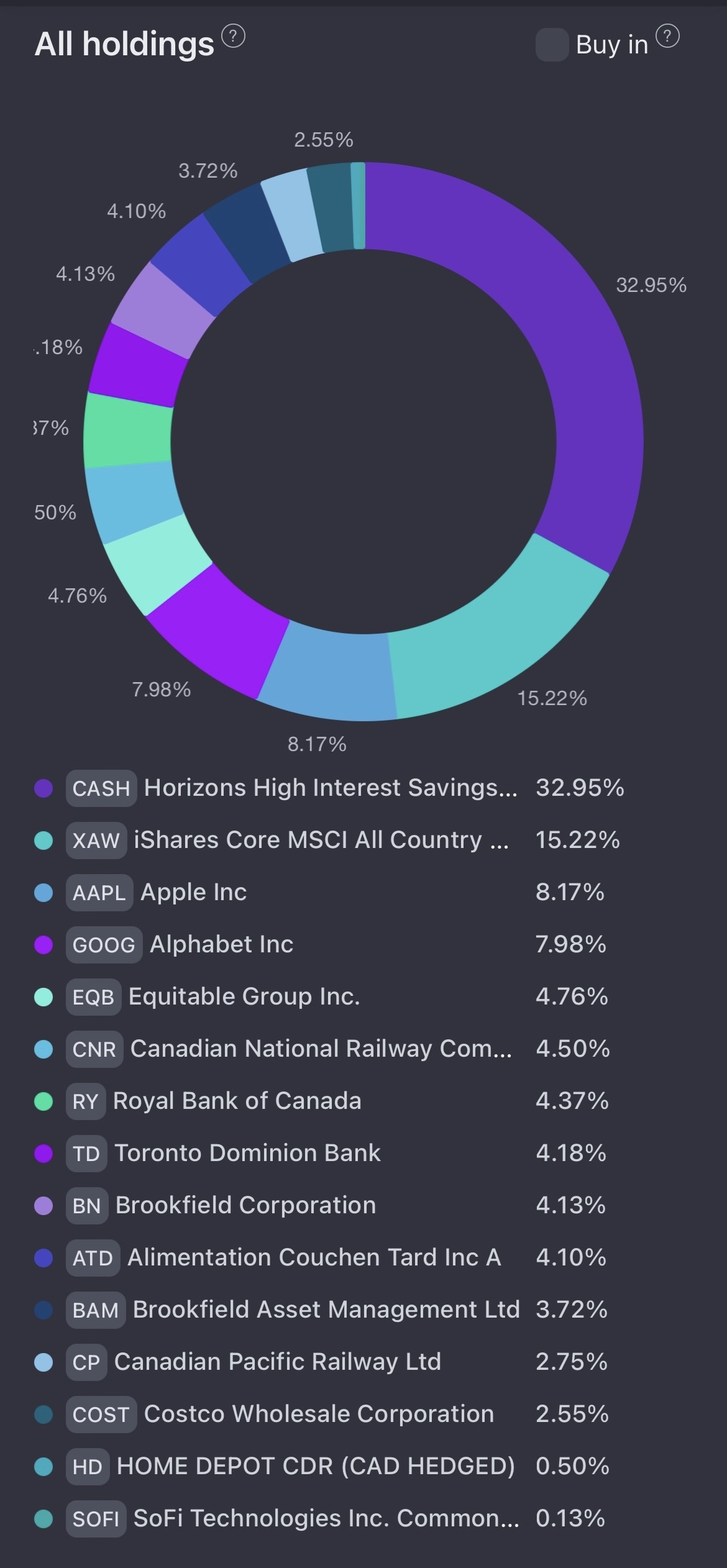

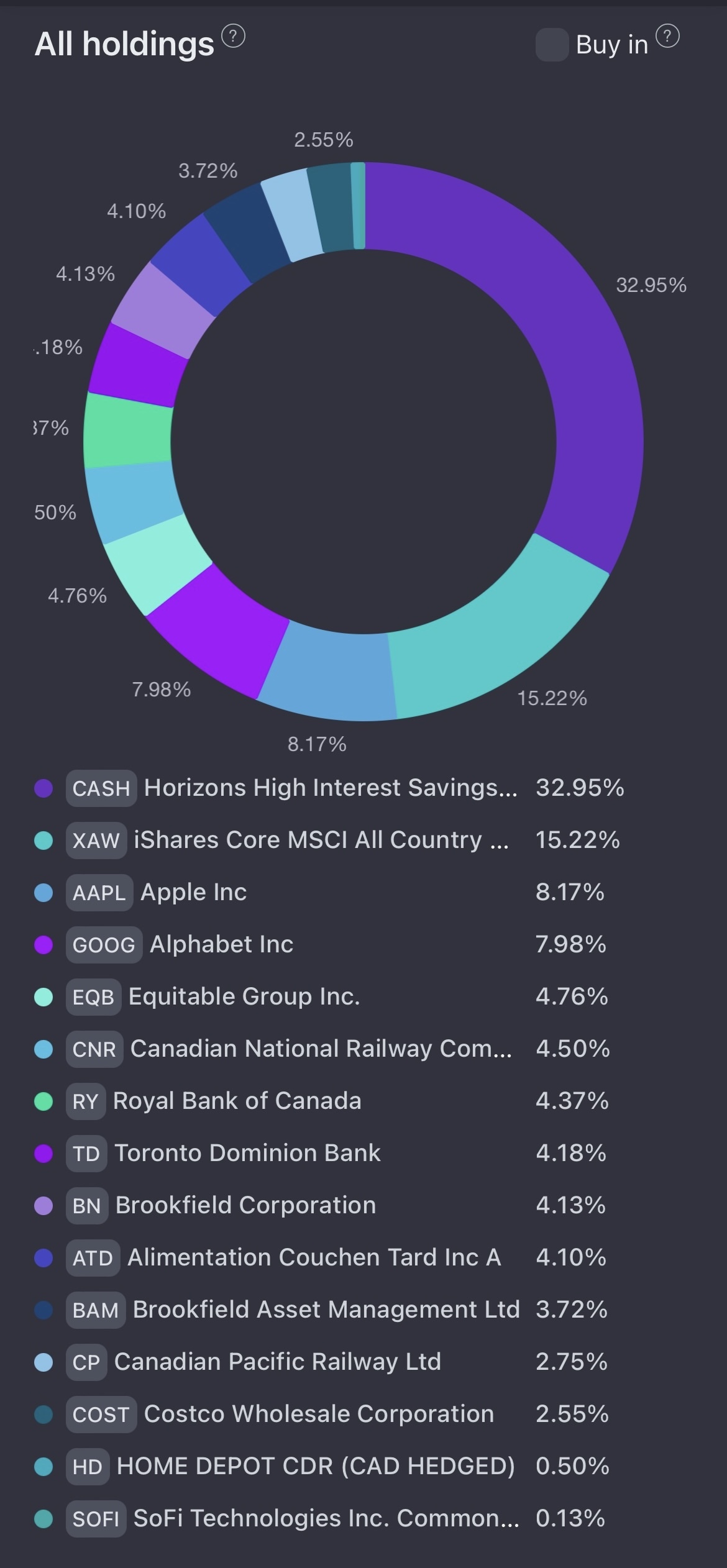

2·3 years agoFor anyone curious, here is what my current investment portfolio looks like,

In my mid-30s, I have maximized my contributions to my TFSA and I am currently focusing on maximizing my RRSP this year. Additionally, I have invested some funds in an unregistered account.

I currently hold a significant amount of cash in $CASH.TO as I am saving up to purchase my first property.

Looking ahead, my long-term objective is to engage in dollar cost averaging by investing in $XAW.TO every two weeks over the next 20-25 years.

One-third of my portfolio is currently allocated to CASH.TO 😄

However, this is intentional as I am saving this portion for the down payment on my first property.

Up: Just $746 more and I’ll hit a new milestone in my investment portfolio! 🤩

Down: I’m just $746 short of reaching that milestone in my investment portfolio. 😩

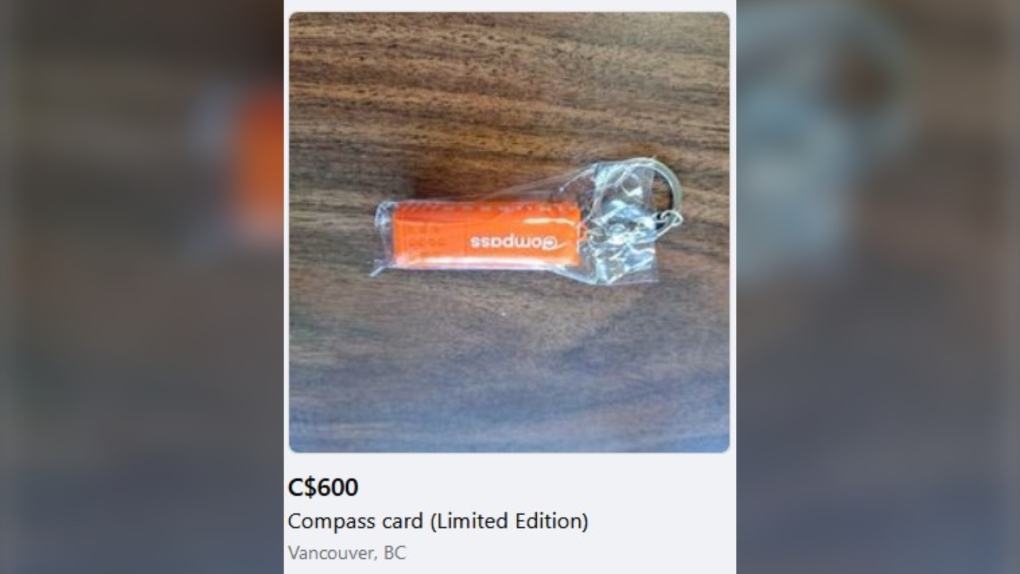

Cute!