Is there anything in the law preventing the insurance company from giving a customer a “go away” premium level? As in “Okay, you’re forcing us to offer a policy in a place we feel we’re going to lose money? $1m/month ought to cover it, you sure you want us to insure you, Mr. Homeowner?”

Is there anything in the law preventing

Insurance companies now have a legal quota, ie a certain percentage of their policies must be in fire-prone areas.

So if their premium is so high that nobody in those areas buys a policy, then they won’t meet their quota.

Soo, the government is making everyone else subsidise living in fireprone areas? Shouldn’t we encourage people to live in cities instead?

You do realize these “fire prone areas” are the cities in California, right?

No, those are small settlements in forests, like Paradise. A bushfire won’t make it through LA or anything like that. Nature should be left to nature, and we should increase density in cities, that reduces the damage humans do to the environment overall, instead of having sprawl taking over forests.

I live in a city where about half of everyone here got stripped of insurance, we are in the foothills and a house hasnt burned down from wildfires for over a decade. You are ignorant of how far reaching these policies are, because everywhere is a fire prone area according to the insurance companies.

Also the cities that are outside of the fire prone areas areover saturated, they need to have density increased and be rebuilt but that aint happening anytime soon.

I used to live in L.A.

I have photos (physical, not digital) of mountains on fire because all I had to do was stand in the backyard of my apartment to take the photos. From multiple events.

These weren’t distant mountains, these were the mountains you would have to drive through to get from my house in the San Fernando Valley to anywhere in the L.A. basin. Like downtown or the beach or my wife’s job.

Along with the multiple mountain ranges the city has swallowed up, L.A. has both a lot of dry brush to catch fire all over the city and the Santa Ana winds to blow cinders onto it.

To sum it all up: there are destructive wildfires in Los Angeles.

Edit: found a non-physical photo of one of the fires on the north side of the Valley, but not a very impressive one that shows flames, just smoke. Oh well.

That’s how insurance works.

Not really.

If everyone facing a similar risk pays for insurance then yes the cost of addressing that risk is shared.

If someone facing additional risk pays the same price then everyone else subsidises them.

Northern California already has subsidized fire insurance called PG&E delivery charges. It just takes a while to pay out through the civil suits.

Uggghh… you mean the upper class liberals who claim to love the poor people would actually have to live with them? No thanks!

They recently closed down my local fire dept then jacked my rates up for not being close to a fire dept. I’m not in a fire risk area, but now I’m 30 mins away from a firetruck.

I don’t want to live in the city.

You make it sound like the same people did both things…

Does it matter if one group or two groups did it? The effect is the same

Would you and your neighbors be willing to fund a fire district? If yes, get in touch with your local representatives to make it happen.

They funded the telco, utilities and property while we funded the salaries. They closed it anyways along with a lot of others, then charged us all a tax for living in an area without a local fire dept.

Our insurance went up about 300% as a result.

San Bernardino county. Yes they deal with major fire prone areas but it’s the largest county in the US, there are a lot of areas that aren’t fire prone.

I realize that you enjoy a rural lifestyle, but it is difficult to fund all of the services you once had with low density housing. The government likely pulled your subsidies and it become financially unviable. The message you are being sent is to live in a more urban area that can afford the services. Not what you want to hear I’m sure, but your choices are limited.

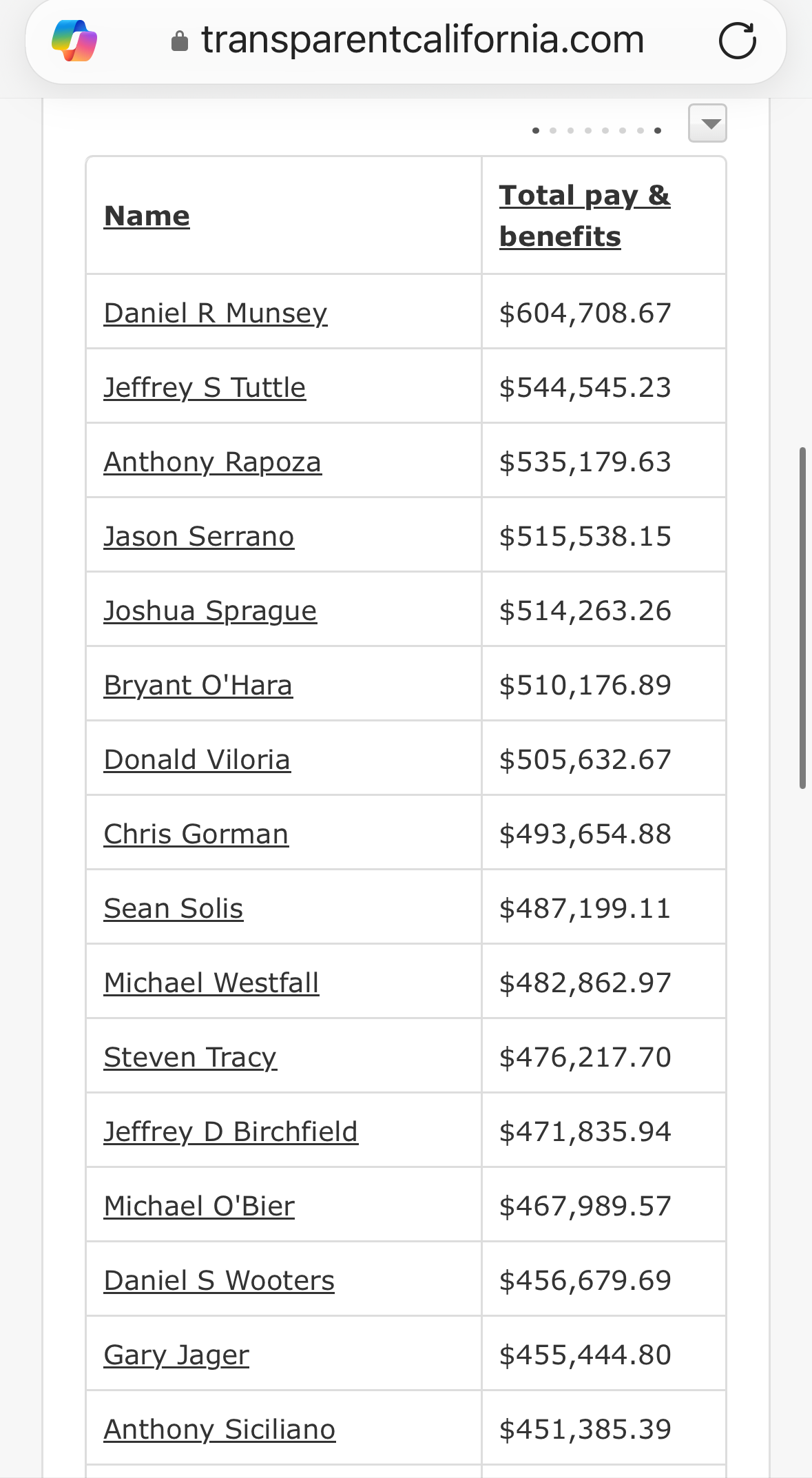

I don’t understand your reply. I see salaries of some people. The salaries seem high, but i didn’t think it would cover the cost of a fire station or operations.

There are some restrictions on price increases but they are allowed to and have been making all sorts of nonsensical demands of homeowners with the threat of cancellation as a way to get out of policies in certain areas.

Maybe the state of California should offer insurance itself if it’s so bad.

But really, between climate change creating tinderboxes and PG&E creating sparks, fire is inevitable.

Colorado actually started doing that for the same reason. They also capped the maximum home value so those building McMansions in fire-prone areas aren’t compensated by the program. The program is also self-funding and can’t tap into tax dollars.

PG&E shouldn’t exist at this point. It’s ridiculous that they weren’t either broken up or taken over by the state.

Neither should for profit SFH insurance companies. The idea is just fucking insane.

They do. A friend in a fire prone area is unable to get fire coverage through his former provider. He was trying to find an alternative last time we spoke, but the estimate from the state was $500/mo. Just for fire insurance.

This seems like a very bad idea… You didn’t want people living in high risk areas. And you’re going to make others subsidize it.

Problem is, everywhere will become high risk eventually. If not fire, then flood.

I live in a ‘high risk area’ e.g. not a paved hellscape. We are a fire safe community.

https://cafiresafecouncil.org/resources/map-of-fire-safe-councils/My father built the house in 1981. Everyone in the community has been paying insurance premiums for 40 fucking years and because PG&E didn’t do necessary maintenance on their lines in paradise, the insurance companies have been pulling out.

Nice thing about “paved hellscapes” is they don’t tend to have runaway fires that cost millions to deal with.

High premiums is the price you pay for high risk. It applies market pressure against such activities while allowing those who really want the risk to continue doing it, at a cost. I only hope California doesn’t step in to subsidize things like they tend to do…

What would likely be more cost effective long-term is to offer a fair market value buy-out of high-risk homes so you can relocate to someplace less “tinderboxy”.

Current firefighting techniques allow fires to take their course in unpopulated areas. Since we are a fire safe community we all have defencable space. The son of the folks at the top of the hill is a wildfire fighter. We know the risks and minimize them. Hell a couple of Teslas burned up and the fire was contained. Due to their batteries it probably took longer to put out than anything that grows around here.

You pretend like insurance companies know best, and ‘market forces’ are these perfect righting forces. I call bullshit.

You pretend like insurance companies know best, and ‘market forces’ are these perfect righting forces. I call bullshit.

I pretend nothing. You’re taking this too personally - I don’t care about you and your situation.

Of course they will make mistakes, nothing is perfect. But there will also be many people moving into high-risk areas and forcing others to risk lives and spend money to save them when there is a fire. The same thing happens with floods due to the FEMA flood insurance program. You see homes being destroyed and re-built in flood-risk areas that should simply be moved to a better location instead.

You see homes being destroyed and re-built in flood-risk areas that should simply be moved to a better location instead.

Difference is that, as was already stated, PG&E are the major cause of a lot of the fires that result in places being deemed as high risk.

This isn’t the same thing as hurricanes: humans can absolutely help stop fires from being the issue that they are

Living up to that bootlicker tag I gave you

I see PG&E mentioned a lot, but as an outsider, I have to ask, are they just being used as a scapegoat? If you have a tinder-dry forest, yes, the most likely spark is going to be from a faulty electrical line. But sooner or later, that forest is going to burn. If not by an electric wire, then by a lightning strike, random static discharge, sparks from a bit of metal dragging on a car, or some random idiot with a cigarette butt.

I’m honestly curious if there has been any kind of study on this. Do acres near PG&E lines statistically burn at higher rates than those not nearby these lines?

have to ask, are they just being used as a scapegoat?

Look up the status of the coupling that caused the camp fire and you’ll see that it very much isn’t, there are pictures of how worn the fucking thing was that they didn’t replace for something lime 80 years despite knowing it was in bad shape

They’re a monopoly that raises prices to cover the cost of the fires they caused through negligence

If you have a tinder-dry forest, yes, the most likely spark is going to be from a faulty electrical line. But sooner or later, that forest is going to burn

While our forest management isn’t perfect by any means, if PG&E had done basic line maintenance then multiple of the worst fires we’ve seen wouldn’t have happened.

And that’s on top of all the usual monopolistic horse shit they pull on us normally, they’re a shit company to begin with BEFORE you factor in the fire starting

Fires will happen, yes, they happen in cities too. San Bruno for example (hey that was PG&E too).

As long as you take the proper precautions (defensable space), fire retardant building materials, etc, the increased risks of living in a wooded area isn’t that great. Certainly not as great as is reflected in the rate increases.

It just means insurers will pull out of California altogether.

They already have. This is a reworking of our current rules. It’s basically goes like this: In California insurance must now provide some insurance in fire prone areas. In exchange California will allow them to use computer models to identify high risk customers and charge them differently. As well, California is promising to reworking our insurance coverage system for insurers. Basically saying in the event of a bad natural disaster California will help provide financial aid.

Lastly the system is encouraging companies to come back by giving in to some of the insurance companies demands. While it sucks, people like me (and there’s a heavy majority of Californians like me) will get lower rates because we live in cities with low wildfire and low flood potential. People in the mountains and along the coast and rural areas will be fucked, but they also wanted relaxed regulation like this.

It’s also substantially better than lots of southern states like Florida which has basically no insurance companies left and those that stay have people paying 12 grand a year for coverage. If I’m recalling correctly the average Californian pays like $1200. We’re far better off, so hopefully this helps a bit and doesn’t completely screw us. ¯_(ツ)_/¯

While it sucks, people like me (and there’s a heavy majority of Californians like me) will get lower rates because we live in cities with low wildfire and low flood potential.

It doesn’t sound to me like this is the situation.

Insurers can offer whatever they want, but if they want to be able to sell to non-high-risk people, they will also have to complete a sufficient number of sales to high-risk customers.

The rule will require home insurers to offer coverage in high-risk areas, something the state has never done, Insurance Commissioner Ricardo Lara’s office said in a statement. Insurers will have to start increasing their coverage by 5% every two years until they hit the equivalent of 85% of their market share. That means if an insurer writes 20 out of every 100 state policies, they’d need to write 17 in a high-risk area, Lara’s office said.

That will cause them to need to set lower rates in higher risk areas than they normally would to be able to complete sufficient high-risk-area sales. That will decrease competition to provide coverage in low risk areas, which will raise insurance rates there.

I’d expect this to be causing people who live in low-risk areas to be subsidizing people who live in high risk areas via higher insurance prices in low risk areas than would be the case in an unconstrained market.

That is, this is a good deal relative to an unconstrained market for people living in high-risk areas and a bad deal relative to an unconstrained market for people living in low risk areas.

I’d expect this to be causing people who live in low-risk areas to be subsidizing people who live in high risk areas

To be fair, high-risk people are subsidized in nearly every type of insurance. Often unintentionally (due to actuarial uncertainty) but sometimes it is an explicit goal.

For example, community rating was deliberately introduced to health insurance in order to cause lower risk people to subsidize high risk people (eg those with preexisting conditions).

As a comparative price point, I’m in the UK and pay about 80% less.

Or how about the state helps relocate people in reoccurring disaster prone areas instead of acting like it’s going to stop if we all just wish hard enough.

And watch as insurance companies pull out of California the same way they did in Florida

deleted by creator

If the government is paying for the company to have profit why don’t the government just do it themselves?

I feel like if the intent is that a private company provide the insurance, they could like force that if they want to do business they need to cover some portion of high risk area, a proportion that does balance things out.

deleted by creator

deleted by creator

“Only $10,000 a month! What a bargain!”

As always I am prepared to pay more in California.

us flood insurance program: part deux

They better be expensive