And all this without declaring war.

And all this without declaring war.

Sounds like they found an actual legitimate target for once.

When two teams show up to play a game of football and one team insists on picking up the ball and running with it, knocking over any opponent who gets in their way — yeah, it’s going to be dysfunctional. Not the game’s fault though, just that the two sides aren’t using the same rule book.

I met my first kid who couldn’t tell time before these teachers were born.

I finally had my “aha” moment when someone demonstrated how to use an analogue clock to find north. And the neat thing is, if you already know where north is, you can use the clock to find a rough lat/long too (longitude by number of minutes away from the nearest zone border, latitude by calculating the real difference between north and clock north based on time of year). Of course, this only works with a proper swiss watch; the ones that don’t have a smooth action but tick between demarcated points spend most of their time being wrong.

Exactly. I’m wondering how many of those teachers could use a slide rule or even an abacus. We’re far enough along now that I bet the majority of teachers would also be lost when confronted with a log table or a topo map and a compass.

Astrolabe and sextant? They’d be totally lost.

I bet most teachers don’t know how to saddle a horse, card and spin wool and flax by hand, or even use a clutch on a manual transmission vehicle, either.

[edit] Ooh… thought of another one! I bet none of the children know how to use a rotary phone either. (In fact, since POTS has been fully DTMF for over 20 years, I doubt a dial phone would actually function today without a converter).

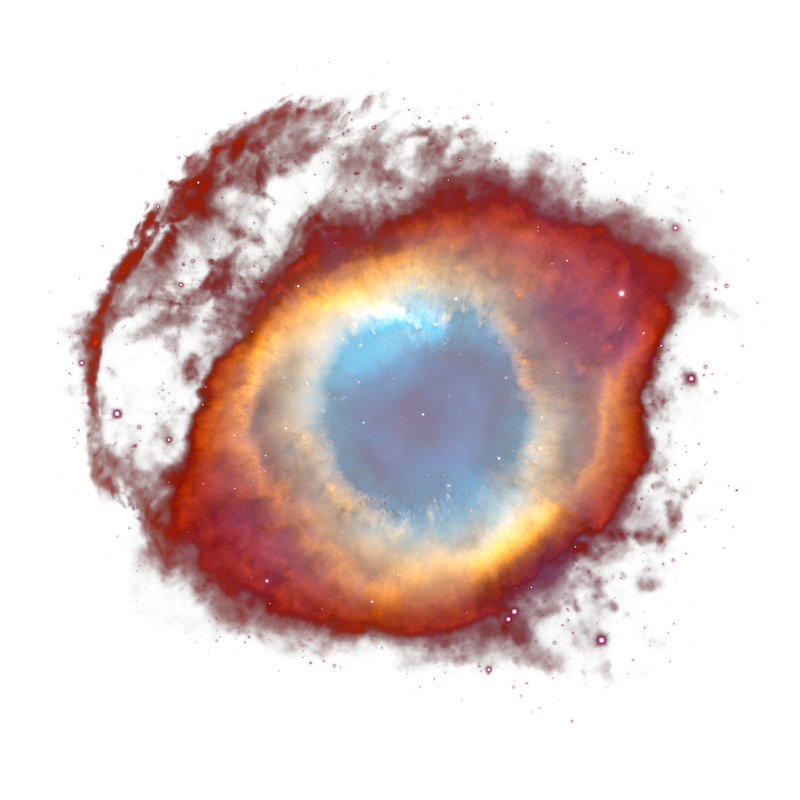

I’ve always wondered if it could actually be a case of relativity, where the particles don’t go anywhere, but other systems brushed close enough to provide gravitational assist out of the stellar gravity well.

Design is the intent behind the product. Good design is when the user is empowered without being able to identify any specific design choices.

Believe what you want… if you aren’t bleaching your plastic cutting boards, you’re breeding bacteria. Wood has anti microbial properties that leeps this under control. See the link upstream for one of the best studies on the topic.

Do asian chefs eat at McDonald’s?

I tossed mine and got a new one.

Plastic needs to be bleached for 30 minutes to remove contamination. A dishwasher won’t be enough.

Dishwashers aren’t some magical tool. They just wash so you don’t have to.

Well, that and… I put wood boards through the dishwasher all the time. Not end grain blocks, but regular low profile boards.

Kurds are Turkish people. If you don’t want them to be, let them separate.

RCS is even less secure than SMS though — it’s unencrypted and by design, Google, Apple and the carriers all have to be able to inspect the content. And the way it’s designed makes it really difficult to have an open E2E encryption standard. So as a result, Google<->Google is encrypted, Apple<->Apple is encrypted, but combine even one device not of the same type in a group chat and it has to be unencrypted.

They keep prosecuting because it costs them nothing and we have to pay for it… and there’s always going to be a chill factor.

How was it life changing?

I’m curious because I can’t see how a bag would handle the multiple tree segments, or how it would let me stack the tree with the other boxes.

I use my original box to store the tree plus a bunch of decorations, and then stack it with the other decoration boxes with a label on the end of each, listing the contents.

GPS would fail as soon as the first tz ticked over. Internet routing would fail instantly too.

At least as long as there’s flaming hoops, they’re still expecting people to be able to jump.

Once Paypal started pushing it via dark patterns, I knew I was meant to be the product.

Why? They want him to target Cuba next so they can take back their homeland.

The whole reason they’re in the US is that they’re anti-communist.