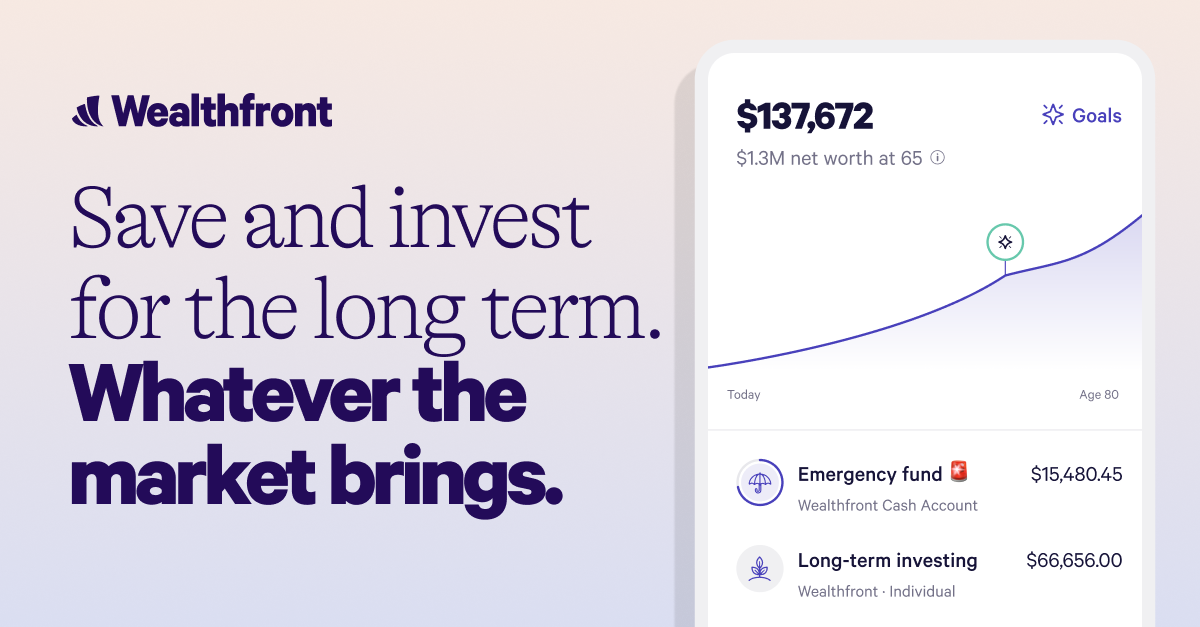

A buddy of mine told me about Wealthfront recently and they’re 5% money market account rates.

Growing up in a world where savings accounts and even CDs never approached more than 2%, the rates on this new thing blew me away.

Free money is great, and I’d love to take advantage of these rates, but the only cash I have currently is the emergency fund I’m trying to build.

Anyone have thoughts on if putting an efund in this kind of service is a bad idea? Not sure if it’ll be liquid enough if a major expense comes up.

I put my entire emergency fund in wealthfront. It was just sitting in a savings making nothing otherwise.

I really like Wealthfront’s automated savings, and their website is top notch. Very easy to use and navigate.

I’ve been using it for a year now and already signed up 3 people. Been nabbing that extra % when I can.