We want food.

Have you pledged your mind body and soul to our lord and savior, capitalism?

mind, body and soul

And your air, and your water, and you land, and your government, and your laws, and your freedom, and your culture, and the minds, bodies and souls of any generations yet unborn, as well as the sacrifice of the potential minds, bodies and souls of generations not born due to the Great Tithe we all must pay in solemness and obedience. Amen.

Oh, so my first born child won’t be required as well?

No, you’ll still need to commit your first born, but we’ll come back for them soon

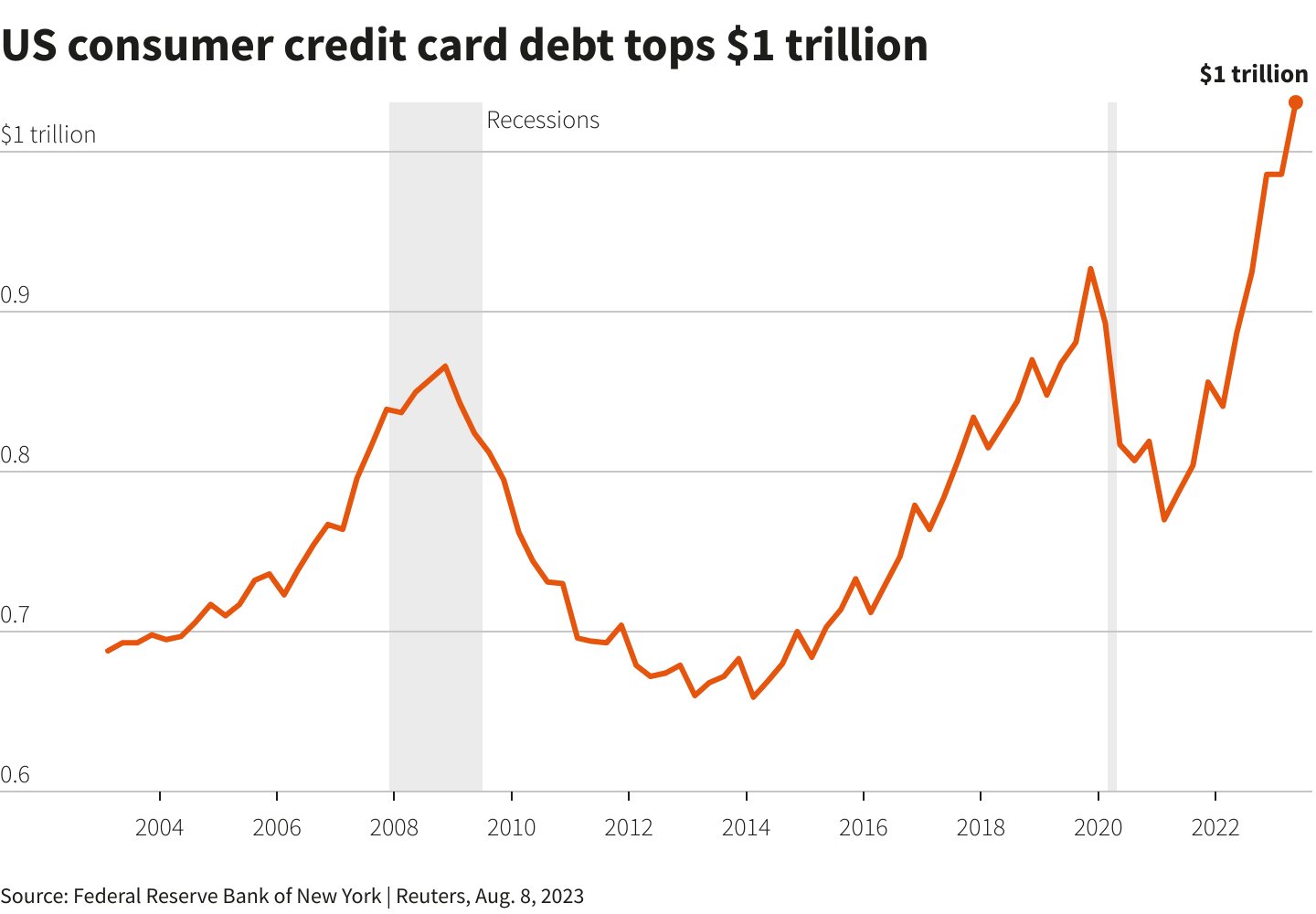

We’re back on pace for where we would have been pre-pandemic.

People chilling out on spending and/or paying down their debt during the pandemic was the weird part.

Prices weren’t jacked to the moon yet and we weren’t commuting. The market readjusted back to torture levels…

People stopped traveling too. This year the record for US domestic flight passengers has been broken and reset multiple times.

Lot of my colleagues are doing bucket list vacations because they don’t give a fuck about saving anymore. They’re convinced the world is ending so everyone millennial and down shouldn’t bother saving.

And I can’t say I disagree with that outlook. But I’m still maxing my 401k to be safe.

Just starve like the communist you really are

\s

credit card companies could lower their APRs in response to a rate cut by the Fed, LendingTree credit analyst Matt Schulz told CBS News, providing some relief for borrowers in the months ahead.

Why in the world would they do that? Has anyone ever seen their credit APR decrease, ever?

They won’t… This is a fud campaign to get peasants to ask for lower rates since fed ain’t listening to the “market”

Renk seeker always charges “what market can bare”

Get peasants to ask the fed? When has the fed ever given a shit about what peasants say

get a few on teevee crying about CC debt and mortgages, create a narrative that regular folks are suffering due to fed not cutting etc

Jesus. We could only hope. I just bought a new car and I know it’s not a credit card, but even with my credit score in the 800s and a third of the vehicle price downpayment, the payments are fucking ridiculous at almost $600 all because of APR! I shopped around for financing too.

Maybe I missed something and am an idiot, but that’s what everything was telling me and even after applying with my bank, seeing what the dealer would offer, and checking some other sources, 5.8% was the best I could get.

Cnbc loves this genre of FUD.

While true US CC debt is up but if you look per capita, it is not.

With that being said, rising debt is an indicator that people are relying on credit to fill gaps. If this continues, they will be fucked

While true US CC debt is up but if you look per capita, it is not.

What do you mean? They aren’t accounting for population increase?

The number given there is gross CC debt… Ie 1.1t

Which I think is historically high but population has grown by like 30m? Since 2008?

So per capita it ain’t highest it has ever been.

Long story short, CNBC is running FUD here.

If a quick search should provide results of this same shit being run every other months.

I notice them running this shit a while back and like clock work they got reposted on socials

The things I would buy with a trillion dollar credit limit! Probably a 2nd air fryer.

Dude imagine. Dual wielding air fryers.

What happens when delinquency rates go up?

Man I knew you were the one posting this as soon as I saw the headline

Doom scrolling is fun! :(

Idk, i think the opposite is way worse. Just pretending everything is fine and be the funny: “look at these cat pictures instead XD”

CBS News - News Source Context (Click to view Full Report)

Information for CBS News:

MBFC: Left-Center - Credibility: High - Factual Reporting: High - United States of America

Wikipedia about this sourceSearch topics on Ground.News

https://www.cbsnews.com/news/credit-card-debt-total-us-2024/