- cross-posted to:

- [email protected]

- cross-posted to:

- [email protected]

Claire*, 42, was always told: “Follow your dreams and the money will follow.” So that’s what she did. At 24, she opened a retail store with a friend in downtown Ottawa, Canada. She’d managed to save enough from a part-time government job during university to start the business without taking out a loan.

For many years, the store did well – they even opened a second location. Claire started to feel financially secure. “A few years ago I was like, wow, I actually might be able to do this until I retire,” she told me. “I’ll never be rich, but I have a really wonderful work-life balance and I’ll have enough.”

But in midlife, she can’t afford to buy a house, and she’s increasingly worried about what retirement would look like, or if it would even be possible. “Was I foolish to think this could work?” she now wonders.

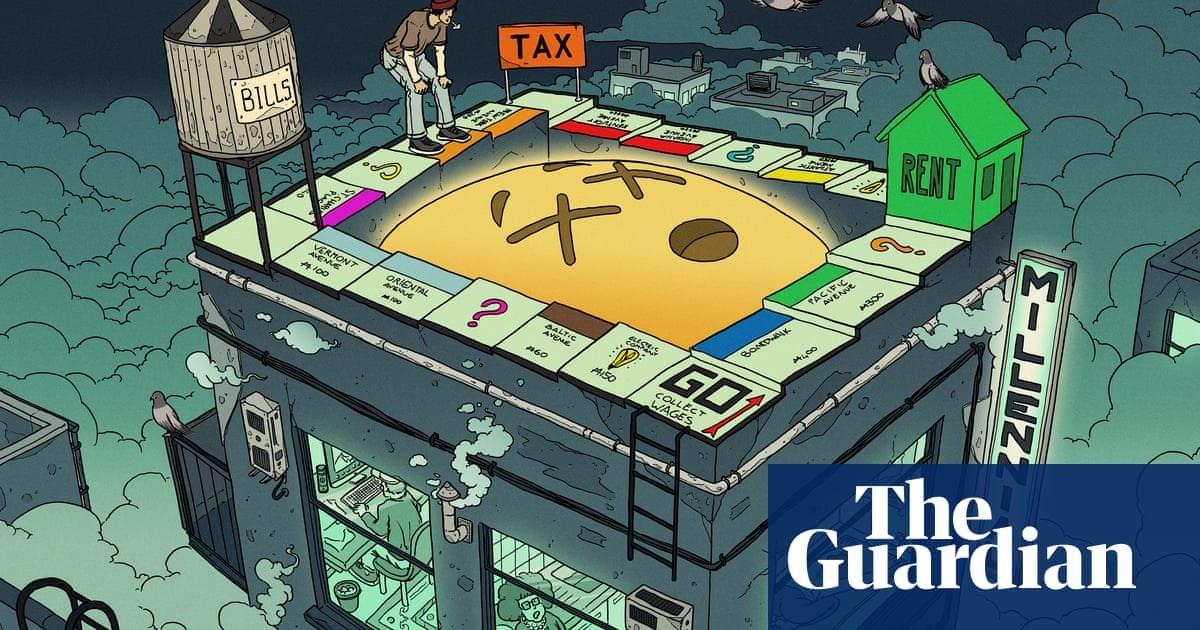

She’s one of many millennials who, in their 40s, are panicking about the realities of midlife: financial precarity, housing insecurity, job instability and difficulty saving for the future. It’s a different kind of midlife crisis – less impulsive sports car purchase and more “will I ever retire?” In fact, a new survey of 1,000 millennials showed that 81% feel they can’t afford to have a midlife crisis. Our generation is the first to be downwardly mobile, at least in the US, and do less well than our parents financially. What will the next 40 years will look like?

“No”

For most of us, the answer is “no.”

A bunch of anecdotes and questions. No answers, historical context on change from defined benefit programs to 401ks under Raegan/Clinton, and no policy prescriptions.

Or hey, how about calling out the growth labor productivity and corresponding lack of growth in real income, if you want the even slightly radical in your take on the concentration of power in capital… but no

Useless fear-mongering article- not wrong though

In the USA, all you have to do is ask Gen-X. The answer is almost always “no”.

- If you made a good amount of money, and have a decent nest egg, the answer is “no” because you have become accustomed to a certain lifestyle and healthcare costs can drain that nest egg very quickly.

- If you made a fuck ton of money the answer is “no” because you are likely having a good time or are someone who has no idea how to stay still.

- If you are broke, you are a financial slave and will continue to be one.

- If you were born rich, sit the fuck down. Nobody want to listen to you and your privilege speak.

Everybody’s all upset about whether or not we’ll be able to eat something besides cat food in our old age.

I say look on the bright side! We created some value for shareholders that one quarter.

People are so defeated about this shit… If we have two whole generations that aren’t going to retire maybe we should just stop working? 🤔 But as soon as you bring up general strikes nobody wants to settle on a date 🙄

“Follow your dreams” is fucking dumbass advice, you’d have to be a fool to follow it.

My mid-life-crisis car cost me less than $15,000.

It was a midl-life crisis in that your car broke down and the only option was to replace it even though you can’t afford to.

No, my GF got a job that she needed a car for because we don’t live in a place with public transit, and I needed a car because we live don’t live in a place with public transit.

But it is fun to drive, when there’s not traffic, so I think it counts.

deleted by creator

Yeah I struggle with this. There are certainly some massive systemic problems with economic inequality and the range of outcomes that people experience… but this seems like an example of someone voluntarily taking a big risk and it not paying out.