My golden rule: If I can’t pay cash, I can’t afford it. Easy.

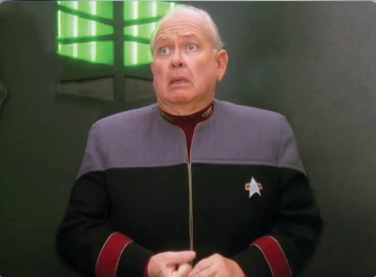

The video above dives into buy now pay later loans and how they’re used in the US. Something I appreciated is how the video dives into the types of fees and interest rates in these kinds of loans to show how they’re designed to make money off of you regardless of how they help you get the products you want.

It’s been a while, but I looked into a few of them at one point (want to say around 2013-2014?). The one I can still recall the details of had a $500-$750 limit on the purchase price, the payments were auto-debited weekly (mandatory), and you ended up paying around 2.5 times the original purchase price. The payment schedule was weekly payments for something like 12 weeks.

And that was a fairly benign one. Some, especially the ones that allowed for higher dollar amount purchases, were practically usury.

The whole “buy now, pay later” industry is entirely predatory.

It should be completely illegal. What are banks for? Only stealing money apparently given the sheer amount of banks that the US government has fined and sued over the past 20+ years.

We don’t need predatory loans. We need to get the criminals out of our banking industry.