- cross-posted to:

- [email protected]

- cross-posted to:

- [email protected]

FTA: The unaffordable cities:

1- Richmond Hill, ON

2- Oakville, ON

3- Markham, ON

4- Vaughan, ON

5- Richmond, BC

6- Vancouver, BC

7- Toronto, ON

8- Milton, ON

9- Whitby, ON

10- Coquitlam, BC

11- Burlington, ON

12- Brampton, ON

13- Mississauga, ON

14- Burnaby, BC

15- Ajax, ON

16- Surrey, BC

17- Langley, BC

18- Oshawa, ON

19- Saanich, BC

20- Kelowna, BC

21- Abbotsford, BC

22- Guelph, ON

23- Hamilton, ON

24- Waterloo, ON

25- Cambridge, ON

26- Barrie, ON

27- Kitchener, ON

28- Ottawa, ON

29- London, ON

30- St. Catharines, ON

31- Montreal, QC

32- Windsor, ON

33- Kingston, ON

34- Halifax, NS

35- Greater Sudbury, ON

36- Longueuil, QC

And the affordable cities:

1- Edmonton, AB

2- St. John’s, NL

3- Regina, SK

4- Saguenay, QC

5- Trois-Rivières, QC

6- Quebec City, QC

7- Lévis, QC

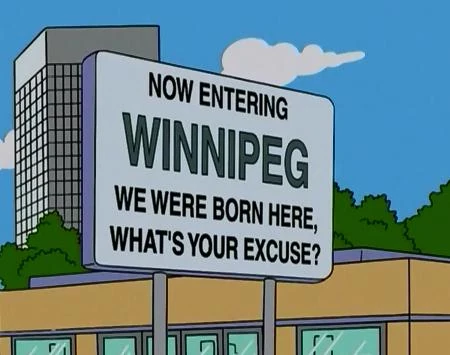

8- Winnipeg, MB

9- Saskatoon, SK

10- Gatineau, QC

11- Calgary, AB

12- Sherbrook, QC

13- Terrebonne, QC

14- Laval, QC

The social contract has failed in Canada. We’ve basically reverted to feudalism (with big TVs & iphones) with barely a whisper. We’re working harder than ever and getting less and less… It’s extremely demoralizing when we realize that all our work is going straight into stock buybacks & real-estate investment funds for the boomers to suck dry, leaving us with no savings, investments, homes, or really anything with value.

Capitalism is indeed somewhat broken in this sense – in its current form, wealth is a funnel, and it moves towards the more wealthy from the less wealthy. However, it’s still not feudalism and it could definitely get worse.

What would you propose as incremental changes towards a future you wish to see?

I think the most important change is to revert taxation to the way it was for thousands of years up until about 100 years ago.

It used to be that all taxes were wealth taxes. A guy would come around, eyeball all of your stuff, guess how much it was worth, and then demand a cut of it for the emperor/pharaoh/ceasar/etc. If you didn’t have anything valuable, the guy would more or less leave you alone.

That’s not how it works now. The main forms of taxation are on income and spending, with tax codes carefully written to avoid any “non-income” forms of revenue. There are very low capital gains taxes on stock dividends, zero on most home equity gains, and loads of ways to avoid those if you’re even remotely savvy. Basically, it’s specifically structured to extract wealth from the working and preserve the wealth of the rich. Personally, I paid nearly twenty thousand dollars in income tax alone while the richest guys in Canada paid practically nothing.

We need to go back to a wealth tax, which worked for 99% of human civilization. It’s easier than ever, considering that every financial institution and government knows your exact net worth down to a few %. The burden needs to be taken off of the working class, and this is the easiest way to do it. No revolution, no eating of the rich – just some rich guys kicking in their fair share.

Of course, we all know it’s not going to happen – the wealthy are far too powerful to threaten their own interests. Until then, we work the fields I guess.

While it’s an ideological answer, it’s relatively balanced compared to the extreme answers others would suggest. I think you’re right, to some extent. At a mimimum it would reduce the whole “generational wealth” bits somewhat, and return things back into the common purse over time.

Between my own taxes, and the corporate taxes I paid through my small business, I feel like I’ve contributed my share. I don’t mind paying taxes, provided the government spending isn’t wasteful. After all, we are a society and rely on public infrastructure, among other things. But I’ve only got a small business, and there’s no off-shore tax havens I’m storing cash reserves in or something ridiculous like the ultra rich. How would you deal with that? Or does your plan only work if implemented more or less universally?

To further add to what you’ve both said, Land Value Taxes (LVT) is probably where we should be heading. Jack those up really high, and lower or even remove income taxes on workers.

Taxing people based on the amount of land they use is a very efficient (from an economic perspective) way to balance wealth. You want a mansion in a desirable area? Go ahead, but you need to pay everyone else for taking up that much space. You want to avoid those taxes by using less space in a less desirable location and investing all your wealth in companies instead? Sounds like a win-win to me.

It’s not feudalism, in that we don’t have a monarchy, but we indeed have a ruling class, and we have a working class that is perennially 1 missed paycheque away from absolute destitution. We get taxed to oblivion, with no services to show for it. Our roads are crumbling, healthcare has almost been stripped from us, labour protections gutted, sick days confiscated, and everything gets more expensive while wages stagnate. Feudalism may be cynical, but this aint your grandpappies capitalism. Fuck neoliberalism. Fuck Nixon. Fuck Reagan. Fuck status quo politicians. Fuck politicians with income properites.

We’re a dual income family making well over the average income for our area and we’re not even fucking close to being able to afford a house. 2 BDRM duplex with no property around the corner from us is going for nearly $700,000, and we’re two hours from Toronto.

At some point the bottom has to fall out.

I’m in quite a high income bracket and by sheer luck bought my house right before the most recent price explosion. My small, poorly built, seventy year old home in a lower middle class neighbourhood is now worth four or five times what I paid. If I was renting, there’s no way I could buy it even though I’m making much more than I did when I got it. I can’t realistically look into upgrading, because the jump in cost to anything nicer is just absurd.

I have no idea how all this is sustainable and even less idea how our politicians think they can keep ignoring it. I know why they’re ignoring it, but they must be aware how this is going to end if they continue to shrug and look the other way.

I know why they’re ignoring it, but they must be aware how this is going to end if they continue to shrug and look the other way.

I don’t think they care. They want to win the next election, and that’s about it. It’s easy to sit back and let the Bank of Canada take the heat.

Oh I’m sure they don’t. I just don’t know how they imagine the next few years looking. Are they all just assuming they’ll be out of the line of sight when things come to a head?

The bottom will not fall out unless some very drastic policy changes are made. Those policy changes won’t be made until ownership rates drop significantly (they’re still very high, around 65%)

What we’ll see is a plateau instead, where rates can’t go higher simply because not enough people can afford them, but we won’t see a drop either.

I agree. As long as the majority of voters live in houses, it’ll stay the same. Homeowners will vote in favour of their own self-interest. Constrained supply means increased demand and higher prices.

Seems irrelevant to a single property owner though, unless you have an escape plan. Especially if you have a mortgage and stand to take a big hit when interest rates go up.

It’s not going to fall out until they eliminate the principle residence tax exemption, and at the exact same time, put some actual restrictions, with teeth, around capital requirements to get a mortgage. Matched with rising rates, this wouldn’t pop the market, it would implode it. It would also hurt a whole bunch of innocent people, but honestly, it’s what it’s going to take. Probably will cause a pretty big recession too, because our GDP is so tied to the housing market now. But that’s what it’s going to take, and it sucks, but that’s the mess we are in…

it doesn’t have to fall out every as long as the govt does low interest rates. which is what everyone is screaming to get back to now that rates have raised.

low interest rates allow the wealthy to borrow money for free and buy up assets and increase the value of assets. they support a economy based on financialization and speculation rather than the growth of trade.

for the bottom to fall out interest rates have to remain high and supply has to vastly increase. we also have to become comfortable with inflation and wage growth, which will erode the value of assets.

our current economic scheme hates wage growth and inflation, and loves low interest rates and inflated asset prices. this doesn’t benefit ordinary people. it benefits the wealthy.

Yeah, that’s ridiculous. Unfortunately house pricing is largely in the hands of local governments – municipal or provincial. NIMBYism gets in the way on the local scale. It’s a weird game theory thing.

My parents have been saying that for at least my entire life (20-something years). I’m at the point where I’ll believe it when I see it. It may be pessimistic, but too many people in power are just all too happy to let people become homeless.

In my opinion, Airbnb shouldn’t be a thing here right now. Multiple personal properties shouldn’t be a thing here right now. Certainly not when hard-working, good people are starving on the streets. Nothing will change unless we actually change things. If we keep just waiting for magic to happen, we will be forever disappointed.

Anyone who is upset with the current housing market, please contact your officials, and please VOTE when the time comes around. We need a solution.

Today, it’s a random guy down the street. Tomorrow, it may be you or your family. Inflation hurts us all eventually, especially when it just keeps going up.

We are a dual income family, also making well over the average income for our area, and we live like kings. Bought a 4bd house, late 90s build, with an oversized double garage, finished basement yadda yadda yadda for just over $400k a few years ago. Markets starting to go bonkers around us though, because we literally have busses going through our neighbourhoods packed with boomer Ontarians that are trying to infect our housing market with their bullshit.

10 years ago I realized Ontario was a bust. I wasn’t making what it would take to buy a house, my wife was making minimum wage, living in our parents basements. Everyone was like oh you can’t go anywhere, family, what about your friends, etc. On a lark I got a job in Calgary, we drove for 3 days, and by the end of the month my wife also had a job, and we didn’t double our household income, we pretty much tripled it. In one month. It’s since grown quite a lot more, I think alone I now make about 4x what my Ontario salary would have grown to in their sad little attempt to keep me there, and my wife has more than doubled her initial earnings. Which is ironic, because we also live like kings out here, zero debt other than our mortgage, because our overhead is low, taxes are low, the cost of living out here is really good. The politics are a bit weird, but you just kind of smile and nod. To be fair they are pretty goofy in Ontario too. Fuck Ontario, seriously. That place is fucking broken. I mean it’s literally this simple, just find something awesome and move. You have every excuse in the book not to, but there’s a whole world out there, trust me.

Capital gains tax on primary residences.

No politician has the guts to do it, but it would go a long way to fix the problem of people using their houses as investments. No home buyer should have to fund someone’s retirement to get a place to live. The feds can make it a more attractive choice to park money in an RRSP or somewhere else.

I say this as someone who through sheer luck of being born when I was, was able to get into the market before it got stupid. The tax would apply to me if and when I sell. I don’t care. I didn’t earn this windfall. Housing affordability is more important.

I think it’s coming. I agree with all your points, but I think it’s inevitable. It’s what it’s going to take.

It’s not even just housing but most public services too.

It’s already hard to get an appointment with a doctor, registering a car has been next to impossible around here lately, although the latter is more incompetencethan anything.

Immigration in itself is fine, but I feel we sell a pipe dream to immigrants lately.I feel for the younger generation and I’d be glad for this bubble to burst even though I stand to “lose”.

My house has almost doubled in value in the past 7-8 years, and I’m in an “affordable” city.

Only managed to get into the market through sheer luck in timing.I say lose, eh, loosely, because I don’t intend to ever sell this old house anyway, so its market value is mostly irrelevant.

Having a place to call home is a basic human need and people trying to make a life here deserve better.We got realtors banging on our door all the time, “your house has increased by x amount.” Judging by two sales on my street this week, one that didn’t even get to a sign getting stuck in the lawn, and the other a bidding war I’m hearing, I’ve probably gained a couple hundred thou. Especially considering I’ve made a bunch of improvements. But it’s like I told my wife, we just would be overpaying for the next place, and I don’t understand how anyone likes moving, because I sure as shit don’t get off on it. Nope, our house is big enough, nice enough, and has the bones to build upon as we go should we feel the need, I just couldn’t be fucking bothered. They are ripping me out by my fingernails for the nursing home, way I see it.

I bought in Winnipeg when it became time to settle down after moving around a bunch early career. I joke to my friends elsewhere in Canada “I bought a garage and it came with a free house.”

Having lived in Winnipeg, the garage may be nicer than the house…

Admittedly, it’s a very nice garage. Insulated, heated, separate breaker box… the previous owners even ran coax to it underground from the house and were using it as a man-cave with a TV, surround sound, and an old couch. Depending on the audience, I describe it more as a workshop than a garage. The perfect place to start a small business. :)

Sounds awesome! I just like to rag on Winnipeg because my wife is from there.

It has its charm, for sure.

yep. zero “affordable” cities in BC

Nothing affordable in Ontario at all. Yikes.

It’s mania. Boomers cashing out, and people with way too much debt flying around, just willing to spend whatever it takes. In my hometown, I think the average wage in the area is somewhere around $20 an hour, and the average price of a house is about $800k. Because the boomers fled Toronto, and infected our area, and now the actual residents are priced out. So now all our parents are selling the houses we grew up in for a cool Mil, which on average is about nine or ten times what they paid for it, and padding their overloaded RRSPs and Pensions with anotner mil. Four+ generations of my family lived there, there’s townships named for us for christ sakes, and I cant afford to live there. Fuck em though, whatever. Place can rot, the praries and the Rockies have my heart now.

Why is Quebec cheaper than the rest?