The EU is moving forward with plans to impose customs duty on cheap goods in a shift that could hit imports from online retailers and harm a hoped-for London listing by the fast-fashion seller Shein.

The potential change comes amid growing disquiet among retailers based in mainland Europe, the UK and the US about rising competition from Chinese-linked marketplaces Shein and Temu, which exploit a loophole that excludes low-value items from import duty.

In the EU, the threshold for the levy is €150 (£127) and in the UK it is £135, enabling retailers such as Shein to ship products directly from overseas to shoppers in those markets without paying any import duty. In the UK, items valued at £39 or less also do not attract import VAT.

Good. Those two are pretty well known for horrible labor conditions.

This isn’t helping their labor conditions though. It’s just helping companies like Amazon to sell the same junk at a higher price, as Amazon sellers buy the same products from Alibaba, and eliminate competition.

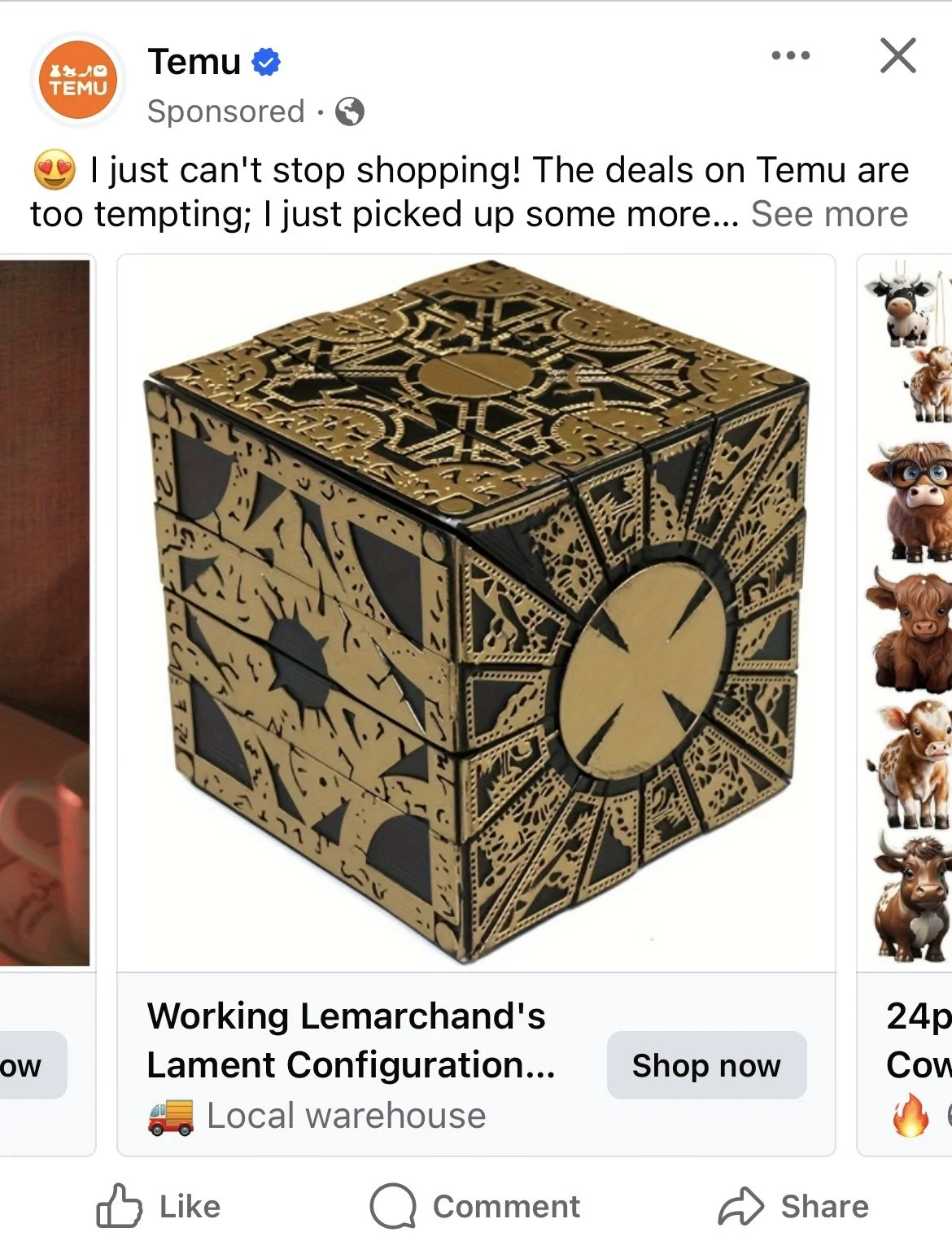

I don’t know if I would fuck with Temu…

(That was an actual ad in my feed.)

The Finnish Flash could kick their ass.

I hope this doesn’t spread to the US as although it’ll stop Temu and Shein, it’ll also probably make niche goods and hobbyist parts more expensive. I really don’t want to pay the Amazon tax if I can find the same thing on Aliexpress, and a duty would just shorten that gap.

Good news! I’ve not bought anything from china or made in china for years (easier than people claim).

This is the best summary I could come up with:

The EU is moving forward with plans to impose customs duty on cheap goods in a shift that could hit imports from online retailers and harm a hoped-for London listing by the fast-fashion seller Shein.

The potential change comes amid growing disquiet among retailers based in mainland Europe, the UK and the US about rising competition from Chinese-linked marketplaces Shein and Temu, which exploit a loophole that excludes low-value items from import duty.

In the EU, the threshold for the levy is €150 (£127) and in the UK it is £135, enabling retailers such as Shein to ship products directly from overseas to shoppers in those markets without paying any import duty.

Last year, 2.3bn items below the duty-free €150 threshold were imported into the EU, according to a report in the Financial Times that highlighted the potential change.

Some countries impose import duties of up to 30%, he said, and having to pay that would force Shein to either completely change its business model, put up prices or take a hit on profit.

On Tuesday, Simon Roberts, the boss of Sainsbury’s and Argos, called on a new government to look at unfair taxes including business rates and import duty.

The original article contains 521 words, the summary contains 200 words. Saved 62%. I’m a bot and I’m open source!

? under 150 euro the VAT is already automatically collected via IOSS, or it would be held at customs even if it’s declared as gift with 0€ value.

which exploit a loophole on low valued goods

In the article.

In the EU, the threshold for the levy is €150 (£127) and in the UK it is £135

In the UK, items valued at £39 or less also do not attract import VAT.

Last year, 2.3bn items below the duty-free €150 threshold were imported into the EU

But it’s not true. The threshold now is 0€, everything needs to pay vat since one year ago. Over 150€ it just can’t do the automatic ioss vat payment

This article from the Financial Times explains the problem.

In a nutshell this isn’t about VAT, it’s about “Customs Duty” which are apparently two separate things in the EU.

I’m in the United States and we’re struggling with this same issue. The flood of cheap goods being imported via TEMU / SHEIN that intentionally stay below the value required to pay import duty is large and growing problem.

It’s also bad for the environment in every way imaginable.

Ah i get it. But that tax is minimal and applies on specific hs codes. Like “additional 10% on polyester fabric shirts manufactured in that specific country”

I assumed it was applied it anyway together with the vat, it’s technically possible during the ioss declaration. Maybe it’s difficult to calculate for small stuff as especially clothing do the tour of the world, manufactured in Bangladesh, labeled in turkey, sent back to china for logistics

At least now everything is taxed at ~20% and china post seems stopped abusing the postal service by canceling their package service to Europe (source for that, a month ago I personally tried to send a package to myself from a Chinese post office, they said they don’t do that anymore, had to fit the stuff in the luggage) so now Alibaba and similar they ship a big container to Europe with combined orders and then use local shipping

How the us is doing by having the threshold so high is insane, leaving door open to abuse. It might made sense until the 80s when international trade was limited to big imports and there was no e-commerce. In my country every single package would declare a value of 799 and nobody would pay a dime lol